Tracking the Biden Boom in the EV Supply Chain

by Jay Turner, professor at Wellesley College and author

In August 2021, President Biden announced a goal for 50 percent of US car sales to be zero-emissions by 2030. The goal wasn’t just reducing carbon emissions. It was about leveraging “a once-in-a-generation investment and a whole-of-government effort to lift up the American autoworker and strengthen American leadership in clean cars and trucks.”

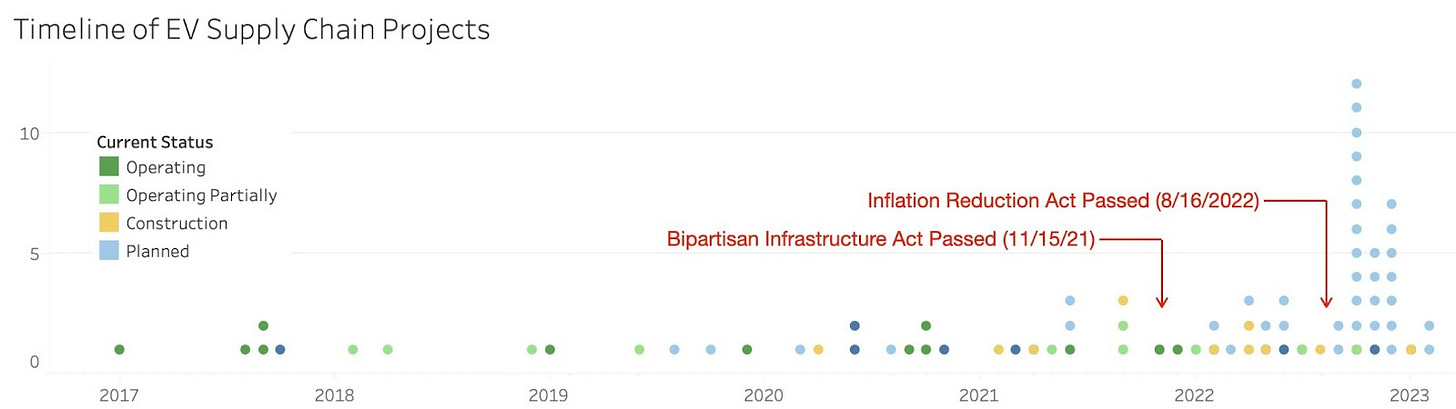

The Bipartisan Infrastructure Act and the Inflation Reduction Act set that plan into motion, putting billions of dollars of government support into accelerating investments in a domestic electric vehicle supply chain. And the industry has responded. Over the past two years, there have been nearly 50 major announcements, from new mines for critical materials to new EV factories.

How big a deal is this? To take measure of the expanding EV industry, my students and I have been systematically tracking project announcements, tabulating capital investment, target production levels, projected employment, and more. Our interactive dashboard reveals an auto industry on the cusp of transition.

Before getting to the numbers, it is worth remembering that this vision is hardly new. Back in October 2009, Vice President Joe Biden took the stage at a shuttered GM auto plant in Delaware. “We are making a bet on the future,” Biden announced. With a $500 million loan from the federal government, Biden envisioned that electric vehicle start-ups like Fisker Automotive were going to help “write a new chapter in the automotive history of this country.”

Things didn’t work out that way. Despite government support, Fisker filed for bankruptcy in 2013. The Delaware factory never turned out a car, and over $100 million in Department of Energy loan funds went unrecovered. To conservative critics, Fisker’s failure — like that of other clean tech companies including Solyndra and A123 — was emblematic of all that was wrong with the Obama administration’s efforts to jumpstart a clean energy transition.

In the early 2010s, while US policymakers bickered over the collapse of Fisker, China chose a different path. At the same time conservatives blocked further government support for clean energy manufacturing in the US, China doubled down on its commitment to building out an EV supply chain and the advanced battery industry needed to support it. China’s subsidies, lending policies, and other incentives that favored domestic manufacturers helped give China a big lead in manufacturing EVs, lithium-ion batteries, and the materials that go into them. This is a story I tell in more detail in my new book Charged: A History of Batteries and Lessons for a Clean Energy Future.

How big was China’s lead? By 2020, China manufactured three of every four lithium-ion battery cells globally and it was putting them into its growing EV manufacturing industry. Between 2010 and 2020, China manufactured nearly 5 million EVs — more than double what the US produced. While the US marveled at Tesla’s meteoric rise in the 2010s (which, incidentally, was jump-started by another 2010 Department of Energy loan), China built out an entire electric vehicle supply chain.

All of this helps explain why the Bipartisan Infrastructure Law and the Inflation Reduction Act are so important. They are key to making good on Biden’s long standing promise to write a new chapter in American automotive history and put the U.S. in position to take meaningful action on climate change. And judging by how the industry has responded, the strategy is working.

This timeline shows just how big the boom in project announcements has been over the past two years.

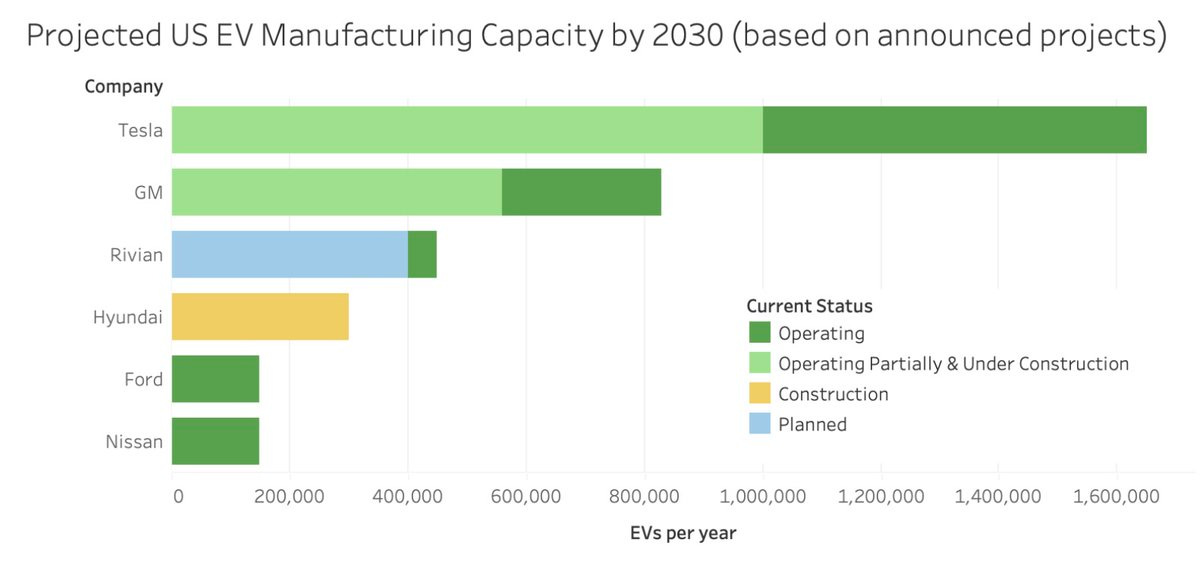

Domestic EV manufacturing is now on track to reach 4.5 million vehicles a year, with more projects in the pipeline. Once preliminary plans announced by Ford, Honda, Volvo, and BMW are finalized, production levels could meet the Biden administration’s goal of 50% EV sales by 2030.

Domestic battery manufacturing is now outpacing plans for EV manufacturing. Battery manufacturing capacity is targeting 950 GWh by 2030. If each EV has a 75 kWh battery pack, that is enough production to support 12 million cars per year.

The biggest challenge, however, will be scaling up mining and materials production to keep pace with the battery and EV production. Securing permits for and bringing mining operations online typically takes much longer than building out manufacturing capacity — and that is the case with the recent growth in the EV supply chain.

That old GM car factory in Delaware is long gone. The site is now a distribution center. But elsewhere in the United States, in response to the Bipartisan Infrastructure Act and the Inflation Reduction Act, the auto industry has begun retooling for an energy transition.

✍️ The Draw-down

Weekly climate art by our MCJ Artist-in-Residence, Nicole Kelner.

🎙My Climate Journey Podcast

🌍 Cody caught up with Martin Wainstein, Founder and Executive Director of OpenEarth Foundation, about the state of carbon accounting at the nation-state level , the innovative ways that OpenEarth Foundation has raised money to date, and some of the big ideas that they're thinking about for the future.

🔋 Megan O’Connor, CEO and Co-founder at Nth Cycle discussed the state of EV battery metal supply chains and battery recycling today, how she started working on this problem in the first place, how Nth Cycle works, and what her plans are for the company.

👩💻 Climate Jobs

For more open positions, check out the #j-climatejobs channel in MCJ Slack as well as our job board featuring 78 MCJ portfolio companies and over 500 open positions.

Account Executive - Enterprise, Strategic Accounts at Arcadia (Remote)

Executive Assistant to the Founders at Artyc (Fremont, CA)

Product Lead at Dispatch Goods (San Francisco, CA)

Assay Scientist at Epoch Biodesign (London, England, UK)

Electrical Engineer at Moment Energy (Coquitlam, B.C.)

Chief of Staff at Noya (San Francisco, CA)

Quality Engineering Lead, Remote Sensing at Overstory (Remote)

Climate Strategy and Development at Patch (London/Remote)

Senior Frontend Engineer at Rheaply (Chicago, IL/Remote)

Lead Field Service Technician at Runwise (New York, NY)

✨ Highlights

🗓️ The SF Climate Week calendar just launched! SF Climate Week is a week-long series of events in the Bay Area, gathering thousands of individuals and organizations working at the intersection of climate action and innovation to connect, collaborate, and accelerate solutions together. SFCW is spearheaded by Climatebase, and all events are independently organized by participating organizations. Register to attend or add an event to the calendar here.

🗓 March Events

Click the event title for details & RSVP info. For more climate events, check out the #c-events channel in MCJ Slack.

🙋♀️ MCJ AMA with Carlos Araque: Carlos is the co-founder and CEO of Quaise, which seeks to unlock the power of geothermal energy by drilling into deeper and hotter parts of the earth, using microwave-based technology rather than traditional mechanical drill bits. Get your questions ready! (3/22)

📚 MCJ Book Club: Join us for a discussion of Speed & Scale by John Doerr. We'll discuss the ideas presented in the book. (3/22)

🏔️ Vancouver Climate Social: A casual get-together for climate-minded folks to mingle. (3/22)

👋 Community Welcome Call: Connect, share and learn with the MCJ team and community members. (3/23)

🎨 Climate Art Workshop: Pop in and paint with MCJ Artist-in-Residence, Nicole Kelner. This month to celebrate the High Seas treaty, we will be painting ocean-based solutions, (3/28)

👭 Women in Climate Meetup: Monthly meetup for women who work in, or want to work in, climate. (3/29)

🤝 Boston Meetup: Come meet up with the Boston MCJ and climate tech community! (3/29)

🇨🇦 MCJ Toronto | Climate Startup Series - The Rise of Social Entrepreneurship: Interested, curious, or passionate about climate? Join us for networking and learn from our local climate entrepreneurs. (3/29)

MCJ Climate Voices is a free weekly email curating news, jobs, My Climate Journey podcast episodes, and other noteworthy happenings in the MCJ member community.

💭 If you have feedback or items you’d like to include, feel free to reach out.

🤝 If you’d like to become an MCJ community member, apply today.

💡 Have a climate-related event or content topic that you'd like to see in the MCJ newsletter? Email us at content@mcjcollective.com

This is great data! How long does it typically take to construct an EV manufacturing site? Despite announcing in 2021, Rivian has yet to break ground on its potential site in Georgia. I think I saw them revise their timeline to 2026, so that'd be 5 years from the announcement.

If I recall various studies correctly, even once EVs make up majority of sales, it'll take 15-20 years to make a significant transition from internal combustion vehicles since vehicles on the road today last more than a decade on average. Do you think government will incentivize buy-backs of gas vehicles, or perhaps a carbon tax will be levied on gas purchases?