The Smart Bet on Green Bonds

by Zach Stein, Co-founder of Carbon Collective

If you’re like us, you spend a lot of time thinking about the climate capital stack.

According to the IEA, the world needs to be investing $4 trillion per year in clean energy by 2030 to be on track for a new zero-energy system by 2050.

Where’s that capital going to come from?

As MCJ readers, you probably have a natural assumption that it’ll be some private investments with government incentives and backing that will fill that gap.

But do you know what private investments need to thrive? Public markets.

For the amount of capital and investors that we need to get in at the beginning and middle of these companies and projects to hit our climate goals, we need a very active public market ready to acquire that debt or equity at the end. Without a plausible exit, earlier stage private investment dries up.

From a returns perspective, green bonds are a strong alternative to traditional bonds. For individual investors, they provide a transparent way to track the emissions avoided through their investments, like a retirement fund. And from a collective-impact perspective, we’ll be unlikely to hit our global climate investment goals without them.

What’s a Green Bond?

Green bonds are securitized debt instruments issued by governments and corporations with a specific mandate to invest only in green projects like renewable energy, new green buildings, or energy retrofits for old buildings. These bonds not only provide audited sustainability reports (like this one from Avangrid) but also offer diversification and potentially lower risks for investors.

For the issuer, the bond structure has proven to be a cheaper source of capital than bank loans in these times of high interest rates. When a company issues a $500m bond, individual institutional investors will ask for allocations in $5 - $10m chunks. Because each investor is only taking on a small part of the bond, the risk to the investor is lower than if a bank issued a loan for $500m. The impact of default on the bank would be much higher than a given individual bond investor, meaning that green bonds have given profitable, investment-grade companies some (small) relief in this high interest rate environment.

Here’s how Bloomberg NEF analyst, Atin Jain put it in a recent article from the team at Heatmap:

“Where possible, if you’re a creditworthy issuer and you’re more financially stable and have the ability to make regular interest payments, you have been viewed attractively by the bond market,” Jain told me. Bond issuance by utilities and renewable developers has more than doubled since before the pandemic, according to BNEF data. “That’s how people are navigating this environment: cutting loan tenors, doubling down on bonds. Everyone is hoping that though they have to tap more expensive debt now they’ll be able to refinance those loans.”

Second, for investors, the liquid nature of these bonds enables them to package any given green bond with a series of others further to reduce the impact of any specific issuer defaulting on the debt.

50 Shades of Green (Bonds)…

But like any part of the climate-capital stack, the risk of greenwashing in green bonds is very real.

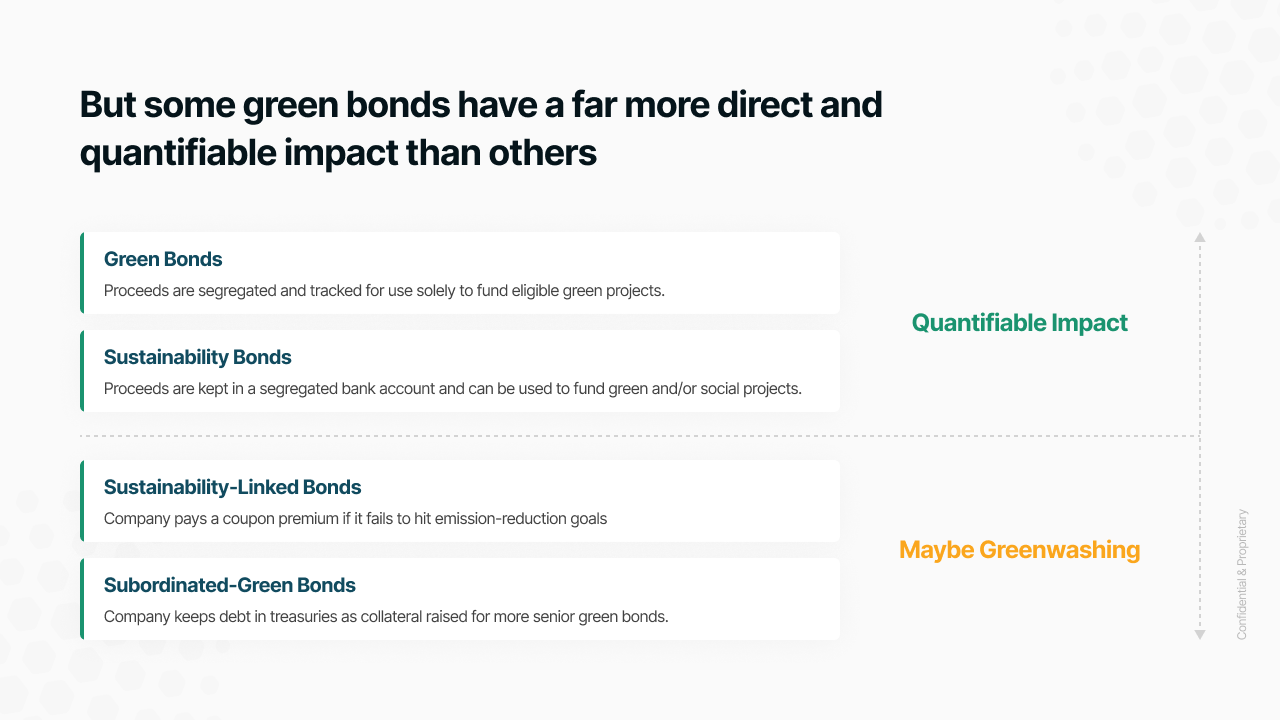

In general, there are 4 categories of green bonds. Two of them have a clear quantifiable impact, while the others are less clear.

One of the more popular forms of green bonds sounds impactful in principle but rarely seems to play out that way in practice (at least so far). Sustainability-Linked Bonds (SLBs) are generic corporate bonds (meaning a company can use the cash raised for any purpose) that will pay out a higher yield if the company fails to meet predetermined emissions reductions.

Again, that sounds great in theory. The perfect market-driven way for a company to price in its failure to decarbonize. But to work it requires companies to make failing to hit their goal extremely painful. And that hasn’t happened. Most SLBs only start counting emissions reductions in the final 1-2 years of the bond and the price of failure is relatively minor, something like a 0.25% bump in coupon. So, on a $1b bond, failing to hit their target could cost the company up to $5m in additional interest payments. That might sound like a lot to you and me, but for investment-grade corporates, that’s a rounding error and not a major motivator to stretch further on decarbonization.

The Important Role of Green Bonds in Solving Climate Change

Fortunately, the use of SLBs has been declining while use-of-proceeds green bonds that disclose how each dollar in the bond was actually allocated (this is the kind we like) has been growing significantly, with over $4 trillion of green bonds having been issued in the last 5 years (not including 2024).

That’s awesome. Because climate finance is like a supply chain, and public securities are almost like the end consumer. When more public securities are looking to acquire green projects and companies, a signal gets sent down to the rest of the capital stack to tee up more supply.

The inverse is also true. If we see demand for publicly traded green bonds shrink, we would similarly expect to see a dampening effect on the entire capital stack as earlier-stage investors lose confidence that they will be able to exit.

In 2023, the globe issued about $500 billion of green bonds. That’s a lot, but it’s still well short of where we need to be for our energy transition goals.

The Unique Financial Upside of Green Bonds

So as an investor, should you invest in publicly traded green bonds?

On the surface, green bonds are fairly attractive. In the US, you can generally get the same yield on a green bond as the same corporation's generic debt. And, at least according to this report from LSEG, the default rate in green bonds has been “significantly below the average default rate of the broader market.”

So the same reward for potentially lower risk and a quantifiable impact as compared to the generic bond alternative?

I’m listening.

But there’s a world where it gets even better. How? Ask your local central banker.

The Federal Reserve in the US and Central Banks around the world have a dual mandate: keep inflation low and employment high. We’re seeing the impacts of them working on the former right now with elevated interest rates around the globe.

Central banks really don’t like inflation.

So what are they going to do about climate change?

It’s not (yet) getting the attention in market commentary that it should but be ready to start hearing the link between climate-driven shortages of key staples and inflation (aka “ClimateFlation”) a lot more in stock market commentary.

In 2024 alone we’ve seen:

Unprecedented drought in Panama led to weeks of delays in global shipping.

Extreme Sahara winds and drought in Western Africa led Cocoa prices to hit all time-highs.

Rice, arguably the most important food staple in the world, jumped to the highest prices since 2008 after El Nino conditions impacted outputs.

The question is not if, but when climate change is brought up regularly by the Fed and central banks. As we all know: it’s here. It’s getting worse. And it’s wreaking havoc on supply chains.

So what can central banks do about it?

They have tools. They can incentivize financial vehicles that specifically build projects that reduce emissions and harden supply chains. They can give subsidized credit rates to banks to increase their green lending. They can enable banks to operate with more leverage if they keep more green bonds on their books. And they can even push for fiscal policy changes, like making green bonds qualify for a similar tax status to municipal bonds or US Treasury bonds (no state tax).

Should any major central bank undertake any of the above actions, it could result in an overnight increase in value for outstanding green bonds.

Green bonds not only match the yields of traditional bonds but also present unique financial upsides. Central banks could further enhance their attractiveness through policy measures like subsidized credit rates or favorable tax statuses, making them a valuable addition to any investment portfolio.

In the fight against climate change, green bonds are not just a financial instrument—they are a beacon of hope, guiding us toward a sustainable and resilient future. As investors, we have the power to accelerate this transition by embracing the green bond market.

🍿 The Lean Back

Learn about Parallel Systems’ solution for battery-electric rail on the MCJ pod.

🎙️ MCJ Podcast

🚂 Matt Soule, CEO and Co-founder of Parallel Systems, joined Cody to discuss how their automated battery-electric freight vehicles are re-imagining rail transport. We dive into the economic benefits of battery-electrified rail, the challenges of short-haul rail transport, and how Parallel Systems is pioneering a new era for goods movement. Listen to the episode here.

🗽 Events: Climate Week NY Special

Click the event title for details & RSVP info. For more climate events, check out the #c-events channel in MCJ Slack.

CDR and Decarbonization Community: Play, Learn, Connect — Noya + Shopify present... not another panel! Join to forge relationships across the carbon removal and decarbonization community in an unconventional - and fun (!?!) - way: by playing Solutions together. There'll also be plenty of time for networking. (Mon, Sept 23)

What will it take to run the grid on clean energy 24/7/365? — Start your Climate Week NYC schedule with David Energy, Cathay Innovation, Union Square Ventures, and other leading grid tech companies as they answer the question. (Mon, Sept 23)

MCJ LIVE Podcast with Tom Steyer — Cody Simms and Tom Steyer will dive into the insights from Tom's book, "Cheaper, Faster, Better: How We’ll Win the Climate War." They'll also explore Tom's journey from his hedge fund days to his work in the climate sector, his 2020 presidential campaign, and his current efforts with Galvanize Solutions. The event will conclude with a networking happy hour. Join the waitlist here. (Tues, Sept 24)

Climate for Kamala — A volunteer-led group of entrepreneurs, investors, workers, and community leaders who have dedicated their lives to addressing climate change… all coming together to support Democratic presidential nominee Vice President Kamala Harris during NYC Climate Week. (Tues, Sept 24)

Ag Land + Climate + Coffee at NYCW — Agricultural lands including forests are essential in addressing the climate crisis, and leaders in this field need to stay connected. Join us for a casual coffee + pastries breakfast hang time to help make those connections happen! This event is hosted by Mary Yap of Lithos Carbon and Chris Tolles of Yard Stick PBC and Shai Goldman of Brex. (Tues, Sept 24)

Roundtable: A discussion on what it takes to build and execute a high-integrity carbon credit strategy today — Patch will bring together corporate leaders and learners for a constructive conversation on how to build and execute high-integrity carbon credit strategies. Under Chatham House Rules, participants will engage in an active learning session to share experiences, ask questions and unpack best practices together. (Weds, Sept 25)

Shifting Trillions - A Collaborative Conversation with Sierra Club Foundation and Carbon Collective Investing — A private conversation with leading endowments, corporates, financiers, investors in public/private markets, and insurers on how we can shift trillions into climate solutions effectively and responsibly. (Thurs, Sept 26)

👩💻 Climate Jobs

For more open positions, check out the #j-climatejobs channel in MCJ Slack as well as our MCJ Job Board.

Environment, Health and Safety Manager at Avalanche Energy (Tukwila, WA)

Solutions Advisor at Calarasight (New York, Boston, or London)

Health, Safety, and Environmental Director at Crusoe (Denver, CO)

Director, Renewable Energy Service Delivery at Euclid Power (Remote)

Business Operations Director at Floodbase (Brooklyn, NY)

Quality Control and Analytical Development Lead at Hoxton Farms (London, UK)

Enterprise Customer Success Manager at Overstory (Remote)

Senior Software Engineer at SPAN (San Francisco, CA)

Biomaterials Research Associate at Tender Food (Somerville, MA)

The MCJ Collective Newsletter is a free weekly email curating news, jobs, My Climate Journey podcast episodes, and other noteworthy happenings in the MCJ member community.

💭 If you have feedback or items you’d like to include, feel free to reach out.

🤝 If you’d like to join the MCJ Collective, apply today.

💡 Have a climate-related event or content topic that you'd like to see in the MCJ newsletter? Email us at content@mcj.vc

This is a hot tip Zach! It's on my todo list now to invest in some green bonds $$$

Was this sentence supposed to start with the word “Without”?

—With a plausible exit, earlier stage private investment dries up.—