You’re Not Too Early: ESG for Startups

by Megan Murday, Founder & CEO of Metric

“We’re building an impactful climate solution – we don’t need to worry about ESG.”

“Our investments are too early stage to think about ESG.”

“We struggle to see basic financial reporting from our companies, let alone a new dataset.”

I’ve heard these responses from founders and venture capitalists when asked whether they do any ESG reporting. You’re not alone if you’re wondering what ESG even means – the acronym is shorthand for environmental, social, and governance performance.

The skepticism comes from a belief that startups need to be singularly focused on growth and an assumption that ESG is only a material concern for highly regulated public companies. There is indeed widespread adoption of ESG transparency in the public markets. The SEC has proposed mandatory climate disclosure, and 92% of the S&P 500 already publish sustainability reports.

Expectations are nevertheless changing for private companies, and ESG standardization efforts are underway. The ESG Data Convergence Initiative brings together GPs and LPs representing $4T in AUM to align on ESG reporting standards for private equity. VentureESG and ESG_VC are working toward ESG alignment and adoption in venture capital.

But aren’t startups too early?

Not anymore. Customers, employees, and investors increasingly expect startups to measure and manage ESG as a dimension of business performance.

Customers expect greater transparency and vote with their wallets. Concerned by climate change and inequality, consumers are aligning purchasing decisions with personal values. In fact, 2/3 of all consumers, and 90% of Gen Z consumers, are willing to pay more for sustainable brands. B2C companies, like Allbirds, are placing sustainability at the core of their operating and marketing decisions for competitive differentiation. B2B companies are no longer exempt, with larger corporations facing pressure from regulators, investors, and their own customers to provide supply chain transparency. If a public company is disclosing Scope 3 emissions, smaller companies in their supply chain then have to share their own emissions data.

Startups compete for top talent and oftentimes cannot win on the salary offer alone. Mission and impact are important differentiators that do not require cash. 86% of employees prefer to work for a company with shared values, and the majority of Gen Z would accept lower pay for better values alignment. Retention rates are also higher when the company shares environmental and social beliefs, lowering turnover and recruitment costs for the company.

ESG management can also affect investor returns. Early product design and operating decisions determine resource intensity. Water, energy, and waste all have price tags, and carbon prices penalize emissions. Sustainable operations position the company to scale more efficiently and profitably. Sound ESG management also lowers the reputational risk for a company. WeWork is a recent example of the valuation risks associated with poor corporate governance. Allegations of racist or sexist cultures can deter future customers, owners, or employees.

Startups still don’t have time.

Large corporations and asset managers have entire teams and outside consultants dedicated to ESG. Startups are lucky to have part of one person’s time to work on sustainability or diversity. Venture investors really do struggle to gather portfolio financial data, – and financial reporting has been around far longer than ESG.

Fortunately, ESG is not all or nothing. Startups can start small, and Metric offers a free tier of access to measure carbon emissions and corporate diversity in less than 20 minutes. Our platform guides companies to focus on the decisions that offer cascading benefits as the company scales. For example, we recommend that seed-stage companies check job descriptions for biased language and share the posting beyond the founders’ personal networks. The company accesses a broader pool of talent and finds candidates that add to the company culture, creating a more diverse early core that improves the likelihood of diversity and inclusion at scale.

Venture funds are pivotal for portfolio ESG performance. Investors can share best practices and lessons learned from other investments. Funds can sign master service agreements with providers to lower costs for sustainability and diversity solutions. Beyond a source of capital, VCs can provide operational value and help founders find competitive advantage through ESG management.

Move fast and build things.

Customer acquisition, employee recruitment, and investment returns support the microeconomic business case for ESG management. The macroeconomic business case is just as pressing. Startups need a healthy system to compete and grow, but the cascading challenges of climate change, inequality, and democracy erosion create instability. Corporate philanthropy is not a scalable answer. New business models, norms, and products hold the promise of aligning sustainability, equity, and profitability. Measurement is just the first step.

Wins of the Week

Spotlighting our incredible MCJ community members.

3️⃣6️⃣ new faces joined the MCJ community! A HUGE welcome to some more amazing individuals, we’re so happy to have you.

👏 S/O to @Sonam Velani (& Co-Founder Lyn) for launching Parachute Earth - a creative research & storytelling project investigating climate solutions in cities around the world.

✍️ The Draw-down

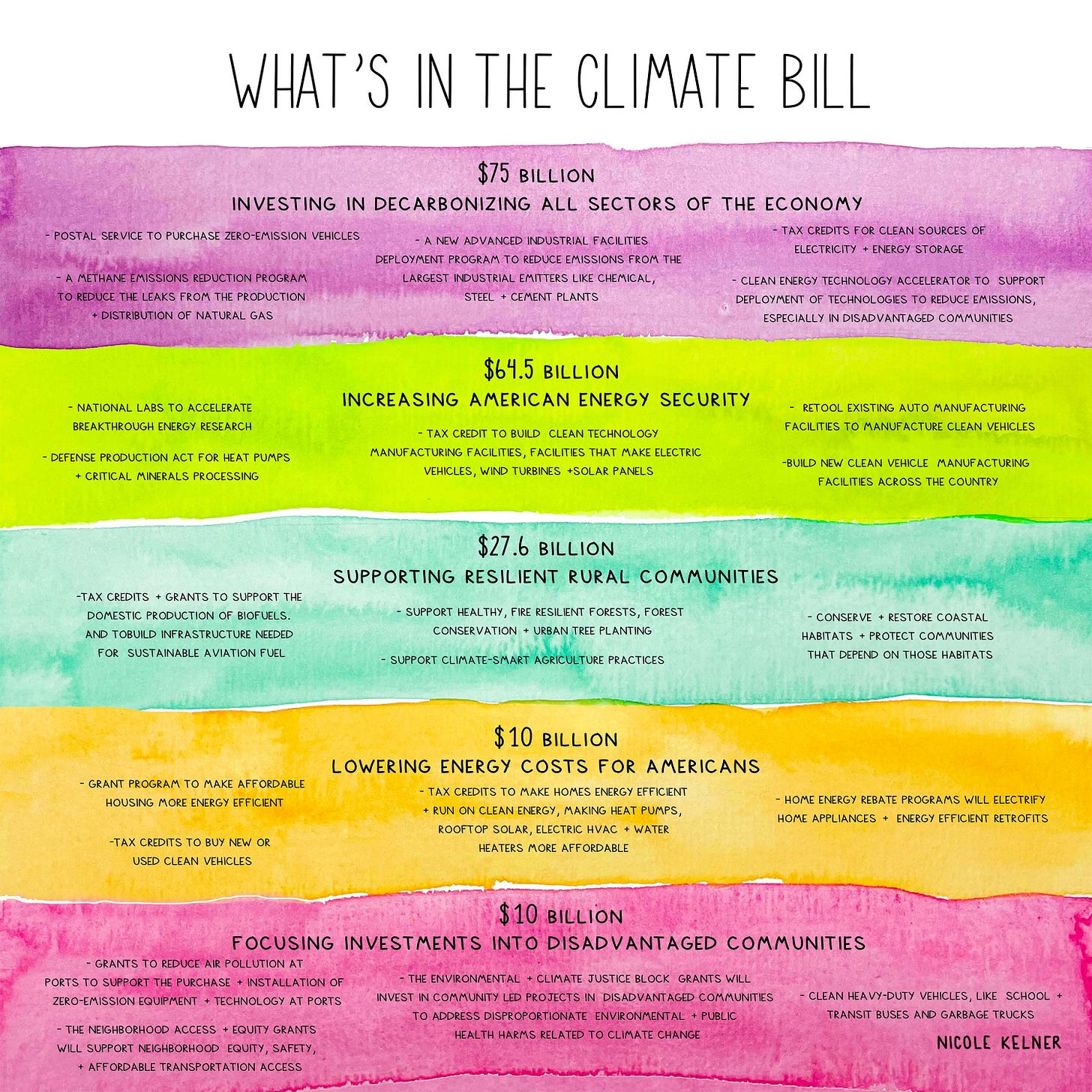

Weekly climate art by our MCJ Artist-in-Residence, Nicole Kelner.

🔎 Fresh Takes

From our marketing friends at The Regenerates.

As the Inflation Reduction Act winds its way from Capitol Hill to the White House, we’re sharing a throwback “What we can do today to build a better future” from Climate Con 2021. It’s a robust chat about cleaning up energy and electrifying Americans to demand the right to rooftop solar. Hear from Saul Griffith, Kiran Bhatraju, Keith Kinch, and Jonathan Shieber. Read here.

🎙My Climate Journey Podcast

💥 Jason talked with Benji Backer, Founder & President of the American Conservation Coalition, about what led him to care about climate change, how he reconciles that with his conservative viewpoints, and the fact that the Republican Party hasn't necessarily put climate change as a front and center issue.

🌲 Cody caught up with Allison Wolff from Vibrant Planet about wildfires, land management, and the role that software and technology can play in unlocking collaboration and effectively addressing the issue.

✨ Highlights

👩💻 Climate Jobs

For more open positions, check out the #j-climatejobs channel in MCJ Slack as well as past newsletters.

AlliedOffsets is hiring a Biz Dev and Data Analyst to help promote transparency within the voluntary carbon market. (London)

Azavea is searching for a Senior Software Engineer, Geospatial Software Engineering Lead, and DevOps Engineer to build advanced geospatial apps for climate and civic impact. (Remote/US/Canada)

Carbon Reform, is looking for a Senior Process Engineer / Scientist to lead the optimization of their proprietary polymer sorbent. (Philadelphia, PA)

Charm Industrial is hiring a Head of Finance to join their carbon removal efforts. (San Francisco, CA)

Heirloom is hiring their first Frontend Software Engineer to guide the overall vision and execution of how people interact with their carbon removal systems. (San Francisco, CA)

Odyssey Energy Solutions is hiring a Vice President of Engineering to lead the company in developing a technology platform to scale distributed energy globally. (Flexible, East Coast/European time zone preferred)

Pano is looking for high energy generalists who are open to contract work over the summer/fall to help in their mission of fighting wildfires with cameras, satellites, and AI.

Pique Action is looking for a Director of Social Media & Audience Growth to join their new media company. (Remote)

Phoenix Tailings is searching for an Operations Manager to join their material science company. (Woburn, MA)

SailPlan is hiring a Chief of Staff, Cloud Engineer & Software Engineer to help maritime operators reduce their carbon emissions.

Yardstick is looking for a VP/Head of Software, Contract Bench/Lab Scientist, and several Soil Carbon Field Scientists to help fight climate change with soil. (Remote/CA/Midwest)

🗓 Events

Full list of MCJ events can be found here.

For more climate events, check out the #c-events channel in MCJ Slack.

MCJ Seattle Climate Tech (8/17)

East Bay MCJ Collective Meal (8/23)

MCJ Women in Climate Meetup (8/24)

MCJ Community Welcome Call (8/25)

Climate Voices is a free weekly email curating news, jobs, My Climate Journey podcast episodes, and other noteworthy happenings in the MCJ member community.

💭 If you have feedback or items you’d like to include, feel free to reach out.

🌳 If you’d like to become an MCJ community member, apply today.