The Hidden Emissions of Grid-Scale Batteries — and How to Fix It

by Jacob Mansfield, Co-founder and CEO of Tierra Climate

Two years ago, my co-founder Emma and I began investigating the emissions impacts of utility-scale batteries and their potential to accelerate grid decarbonization. In our assessment, we realized energy storage is perhaps the most important piece to our energy transition journey.

The U.S. currently operates over 700 gigawatts (GW) of fossil fuel plants. Reaching Net Zero will require converting every combustible resource to some combination of carbon-free energy generation and energy storage. Without assuming any changes to the demand side, such a drastic change to the supply side grid mix was already a tall order. But climate change is intensifying summers and winters, shattering demand records left and right. Now add on unprecedented load growth not seen since the 1950’s fundamentally driven by widespread electrification, industrial reshoring, and AI demand, and the task is even more colossal. What happens if we don’t build all the batteries we need? We face some grim choices: backslide into reliance on fossil fuels, overbuild renewables and curtail excess energy, or risk grid reliability issues, which are already emerging.

It’s clear to us that batteries are the linchpin to our clean energy dreams, and we need to build them as soon as possible. But here’s the catch: our emissions analysis revealed that most standalone utility-scale batteries in operation increase emissions. That’s not what we were expecting to find either... Albeit disheartening, this challenge presents a unique opportunity to course-correct and make batteries into the decarbonization asset they’re meant to be.

The Emissions Problem

One might assume batteries lower emissions by default. After all, they stabilize renewable energy supply, akin to fossil-fuel plants filling the gaps when the sun or wind falls short, commonly referred to as ‘firm capacity’. In wholesale power markets, real time electricity prices send a signal to dispatchable energy resources to ramp up and supply more electricity to meet rising demand. You might expect batteries engaged in energy arbitrage — storing electricity when renewables are abundant and cheap, then supplying it when renewables are scarce and gas plants would typically take over — to naturally lower emissions. The intuition is solid: compare what energy flows into the battery versus what’s displaced when energy flows out. Unfortunately, that is not what happens in practice…

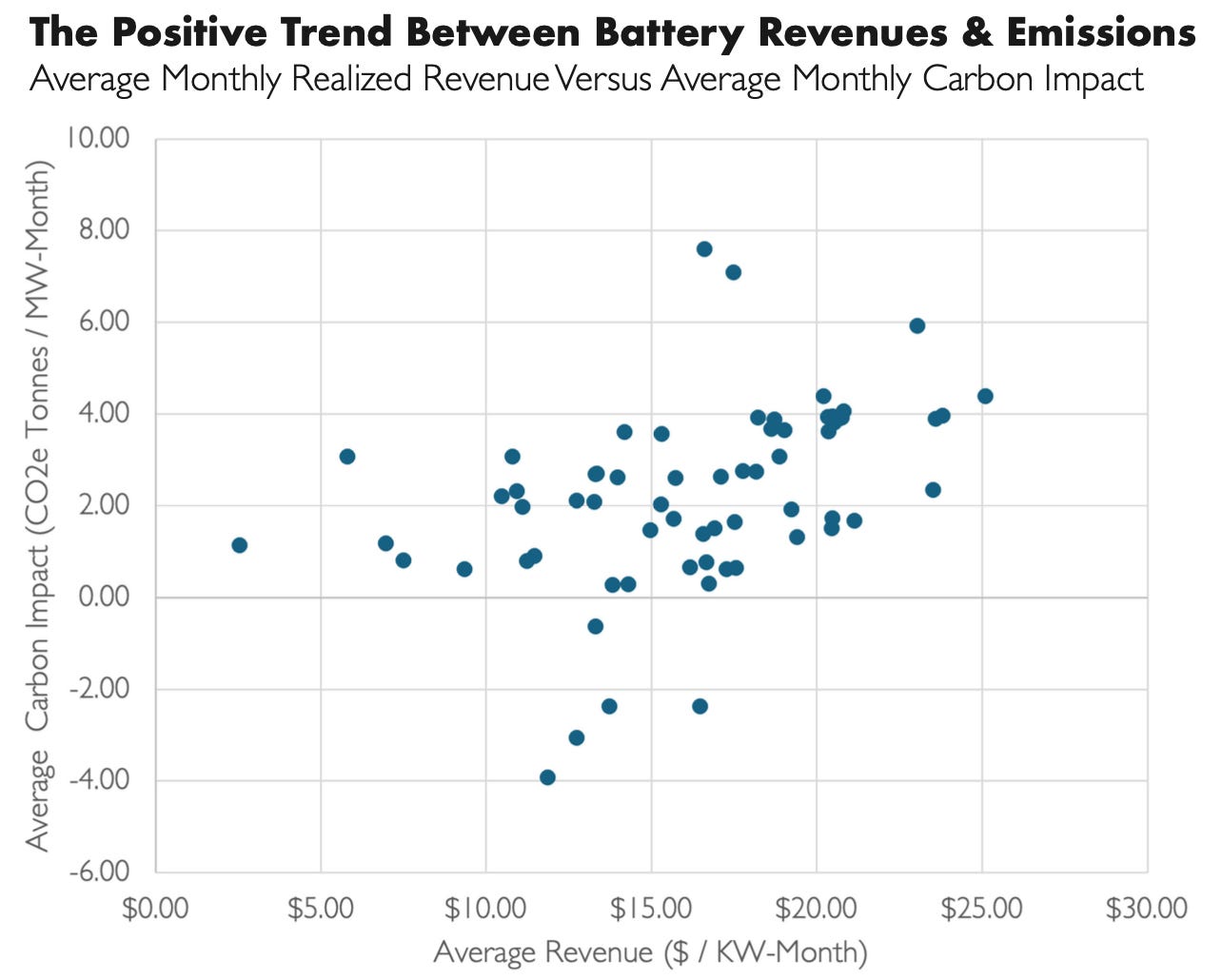

In our June 2024 study, we evaluated 65 operating batteries representing 2.3 GW on the Texas power grid (ERCOT), an energy-only market. Combined with other laissez-faire market conditions, Texas has deployed more wind and solar capacity than any other state in the US and continues to deploy energy storage at a faster rate than anywhere in the world. Yet with all these renewables, we found 92% of batteries caused emissions to go up. We know what you’re thinking: why?! Batteries maximize revenue based on market mechanisms that ignore emissions, operating with misaligned incentives.

Batteries are a net-load on the electricity grid, with lithium-ion batteries losing 10-15% of electricity between charge and discharge. And for long-duration, it can be greater than 50%. If a battery charges with electricity generated from fossil fuels and consumes 15% of this energy, the battery incurs a carbon footprint from the outset. So basically, a battery needs to displace higher-emitting power sources to offset these round-trip losses, but energy prices don’t perfectly correlate with emissions. For example, we found ERCOT’s average Spearman correlation across project nodes was 0.46. In other words, emissions and prices don’t move in lockstep. And given the correlation is sufficiently weak, batteries that chase market signals do not tend to reduce emissions by default. Compounding both these issues, batteries make the bulk of their revenue from a basket of lucrative grid support services called ‘ancillary services,’ deployed at a systemwide level and completely divorced from the project’s location-specific emissions conditions.

The ‘Missing Money’ Problem

Further complicating matters, 63% of energy storage is being built in just two states: Texas and California. Putting aside Texas as a unique case, California has powered its way to the top based on state-mandated procurement and ambitious energy storage targets (like a Renewable Portfolio Standard). That model works if you live in a state with a governor that acknowledges climate change. But what if you live in a red state in the middle part of the country where climate change denialism is rife?

Surprisingly, a large share of renewable energy capacity is sited in these red states where land is cheap, and regulations are few. In these markets, wind and solar have taken off despite state politics, not because of it. But in wholesale power markets like the Midwest Independent System Operator (MISO) and the Southwest Power Pool (SPP), there is virtually no energy storage being built because projected revenues fall short of covering project costs, a challenge often called the ‘missing money’ problem. Either costs like capex need to plummet or market prices need to materially improve to get a project to pencil.

One go-to ‘lever’ to lower the cost of capital would be to put more debt on a project. Whereas wind and solar projects may have as much as 90% debt, batteries are notoriously difficult to finance due to the nature of their revenues. Batteries make money when volatility is high. In fact, in ERCOT we found that 61.2% of the revenue generated in 2023 came in the top twenty revenue-days. And the top five revenue-days accounted for more revenue than the bottom 315 days. This makes it tough to lend against a battery project, which means batteries are more expensive as a result.

Calling All Corporates

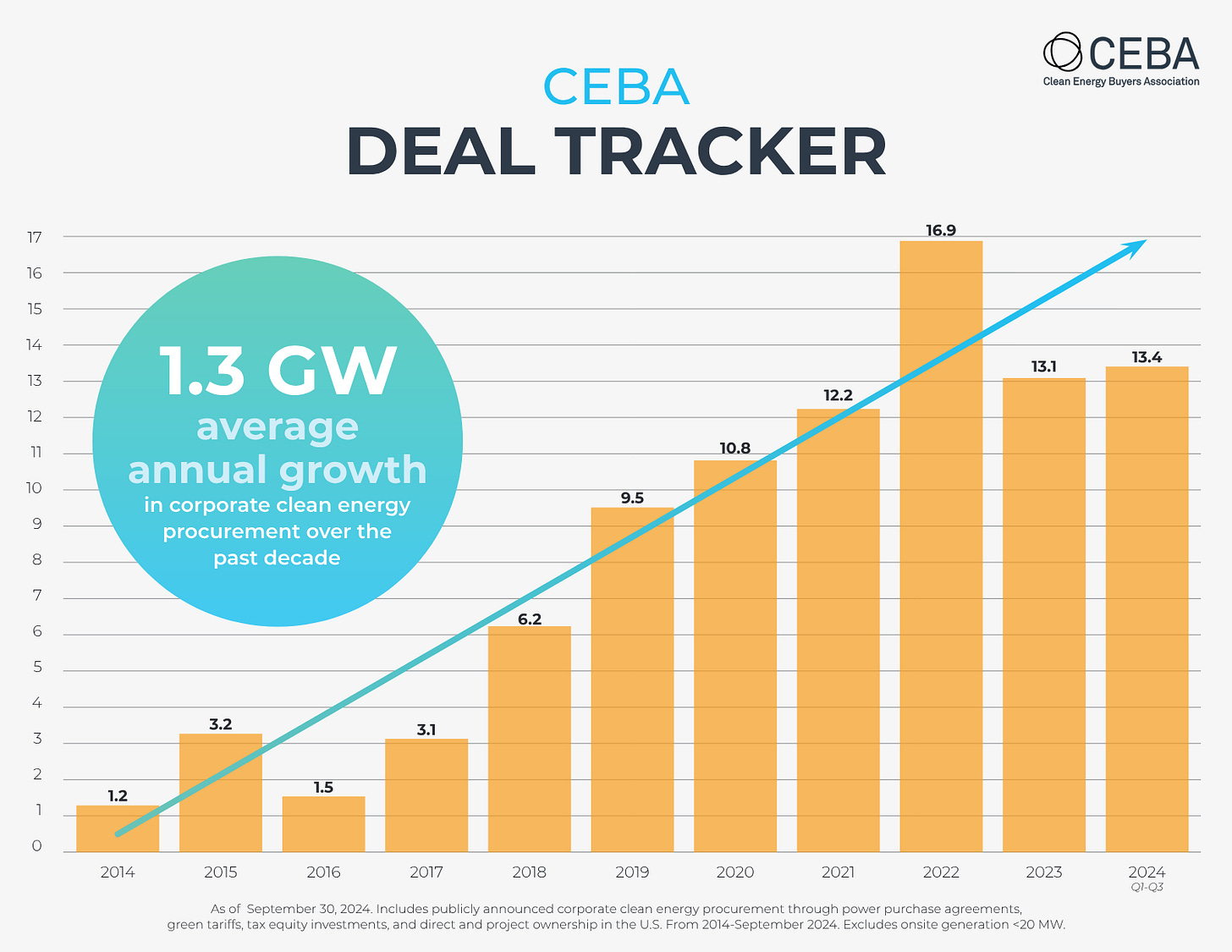

It's said that a problem well defined is a problem half solved. So, with a whole host of problems identified for energy storage, let’s discuss some possible solutions. About a decade ago, wind and solar projects were also difficult to pencil. Fortunately, corporate America stepped up to the plate and started contracting like crazy for renewable energy, catalyzed by industry groups like RE100 and the Clean Energy Buyers Association (CEBA). Now corporate procurements have become a huge force multiplier to accelerate renewable deployments, accounting for over 70% of renewable energy projects built in the US.

Unfortunately, this hasn’t trickled into energy storage yet in part because carbon accounting standards that give credit for renewable energy don’t account for energy storage. The Greenhouse Gas Protocol (GHGP) is perhaps the world’s most influential carbon accounting standard, used by virtually all Fortune 500 companies for their Scope 1, 2, and 3 emissions. The GHGP’s ‘market-based mechanism’ permits companies buying renewable energy to neutralize their Scope 2 footprint, which has since spurred hundreds of billions annually in renewable energy procurements.

Yet, carbon accounting standards weren’t designed with energy storage in mind. The last time the GHGP was updated in 2014, there were virtually no utility-scale batteries. Fast forward a decade and energy storage is the fastest growing energy asset category with approximately ~$20 billion spent annually in the US alone. As the GHGP undergoes its biggest revision in a decade, incorporating energy storage could allow corporates to contract storage solutions much like they did for renewables. That’s why my co-founder Emma sought (and was ultimately appointed to) a position on the GHGP Technical Working Group addressing revisions to Scope 2 guidance.

Beyond standards, energy storage needs a REC-like instrument to monetize its environmental benefits. Tierra Climate is currently pursuing several pathways, including the Energy Storage Solutions Consortium (ESSC), an industry group of over 90 member organizations developing a Verra carbon methodology to make batteries eligible for carbon offsets. A carbon price would incentivize batteries to factor emissions into their operations, creating a new paradigm shift to ‘carbon arbitrage’ alongside traditional energy arbitrage. In our study, a carbon contract not only improved battery emissions impacts across the board but flipped two-thirds of batteries from net-emissive to net-abating. Carbon incentives could also influence critical decisions —technology type, duration, and siting— as well as drive storage growth in markets with limited political support for combatting climate change.

Conclusion

Unlike wind and solar, batteries require software to navigate complicated operational decisions, which means you can’t simply drop a battery on the grid and walk away. And the stakes are even higher given batteries can inadvertently increase emissions simply chasing market price signals. Retooling battery operations to balance revenue goals with emissions reduction goals requires a new suite of data science and optimization tools. By advancing standards, voluntary market mechanisms, and novel digital solutions, Tierra Climate is helping to realign incentives for energy storage and unleash the wave of batteries necessary to stabilize and decarbonize the electricity grid.

🎙️ Inevitable, an MCJ podcast

🌱 Tom Montag, CEO of Rubicon Carbon, joins us to discuss the world of carbon credits, why they matter, the circumstances under which companies should use them, and the origin of his company, including the role of TPG’s Rise Fund. Tom also discusses Rubicon's approach to bundled credit offerings and addresses some of the trust challenges facing the carbon markets today, as well as where he believes they are headed. Listen to the episode here.

✈️ Mark Lundstrom, founder and CEO of Radia, described WindRunner, the world’s largest aircraft, specifically designed to transport massive offshore wind turbine blades to onshore sites. This capability, termed "GigaWind," could redefine the scope and scale of onshore wind projects. Learn morea bout Radia here.

🍿 The Lean Back

Learn about Exowatt in the latest episode of Inevitable.

👩💻 Climate Jobs

For more open positions, check out the Job Openings space in the MCJ Collective member hub or the MCJ Job Board.

Site Reliability Engineer at AMP Sortation (Remote/US)

Financial Operations at Base Power (Austin, TX)

Senior Systems Engineer at Crusoe (San Francisco, CA)

Operations Manager at Enode (Remote/Europe)

Systems and Reliability Engineer at Heirloom (Brisbane, CA)

Molecular Biology Specialist at Hoxton Farms (London, UK)

Platform Operations Analyst at Leap (Remote/US)

Founding Software Engineer at Windfall Bio (San Mateo, CA)

QA/QC Manager at Solugen (Houston, TX)

Staff Accountant at Sumblime Systems (Somerville, MA)

👩💻 Events

🚺 Women in Climate Meetup: This is a monthly virtual meetup for women who work in, or want to work in, climate. We will use a Lean Coffee format, where we co-create the agenda real time and get through the topics that are most interesting to the group. Each month we'll pick an industry learning theme and a jobs related theme to focus on. (Nov 27)

🎄 MCJ New York: Holiday Happy Hour: Your city hosts Grace, Benny and Eliza put together one last gathering before the end of the year to come together, reflect on a year of climate wins, and re-energize for the fight ahead. (Dec 4)

👨💻 MCJ + Climate People Climate Career Advancement Meetup: Climate People and MCJ are collaborating to present a monthly series of invaluable tips and tricks to advance your career working on climate. Our career advancement meetup offers a unique opportunity to learn from experts, build a strong community, and chart your path in the climate sector. Speaker and format to be announced soon! (Dec 11)

The MCJ Collective Newsletter is a free weekly email curating news, jobs, Inevitable podcast episodes, and other noteworthy happenings in the MCJ member community.

💭 If you have feedback or items you’d like to include, feel free to reach out.

🤝 If you’d like to join the MCJ Collective, apply today.

💡 Have a climate-related event or content topic that you'd like to see in the MCJ newsletter? Email us at content@mcj.vc

Micro grids and individual energy independence is the only policy that will truly afford sustainability. A national regional grid is absolutely insanity. No industrial complex paradigm can be replaced with another industrial complex paradigm, and have any consequences of statistical significance concerning the climate catastrophe ahead.

Great analysis! Obviously this isn’t the solution to the entire energy storage problem, but it seems like one way to reduce battery emissions is to charge them with renewable energy in the first place 😊