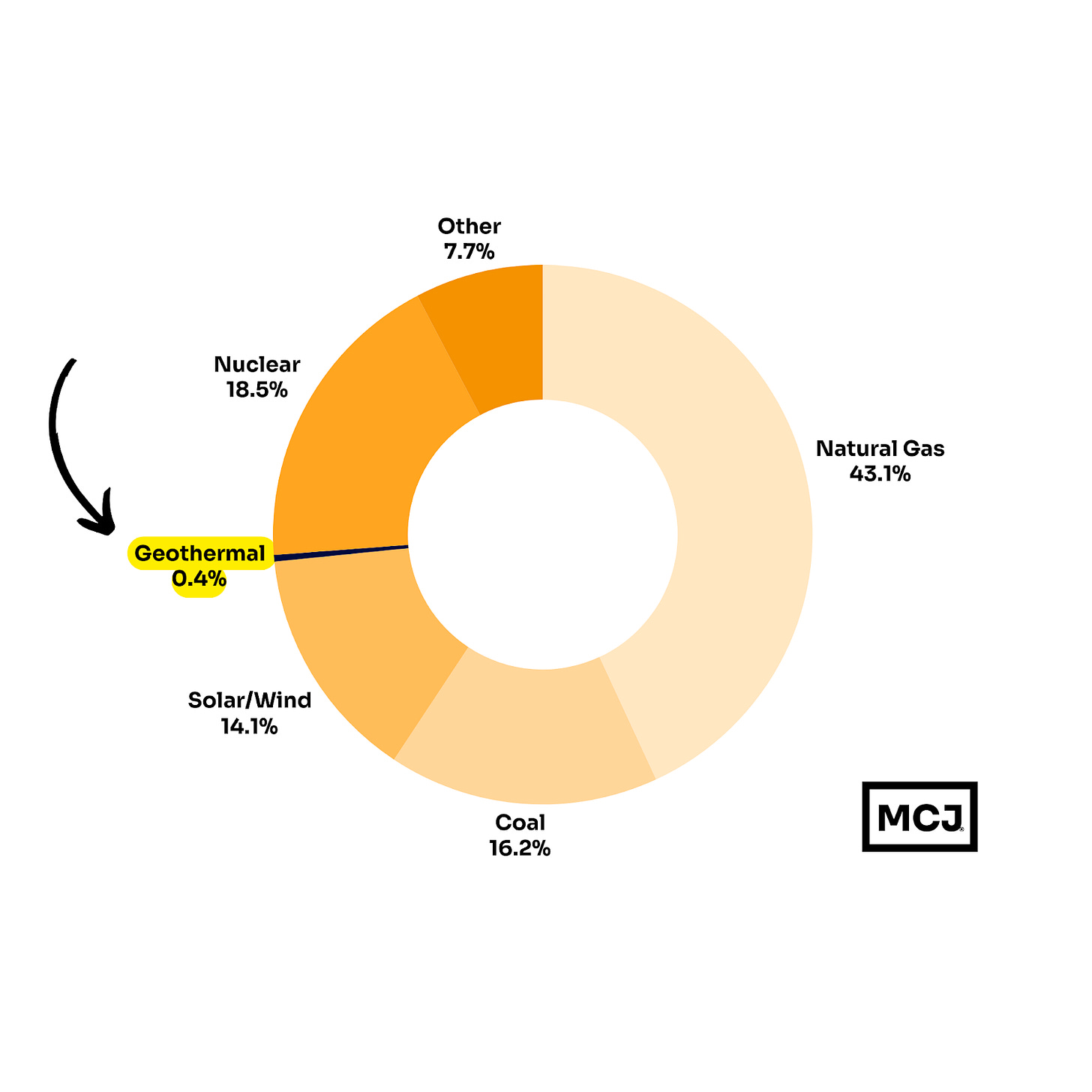

Consider the US’ current energy mix: solar/wind, nuclear, natural gas, coal, and geothermal.

Four of these are firm baseload sources, critical for keeping the grid stable.

Only two – nuclear and geothermal — run at capacity factors above 80%, providing round-the-clock reliability.

And just one of them comes with zero fuel costs: geothermal.

And yet, when we look at the breakdown:

Despite being one of the reliable forms of clean baseload power, geothermal is a drop in the US energy bucket.

Why?

A combination of high OPEX and CAPEX costs, and an inability to access project financing, all underpinned by geologic risk.

But with loosening regulatory restrictions and new drilling technologies bringing faster project timelines, coupled with insatiable demand for baseload power, private capital into next-gen geothermal startups has grown more than 5× since 2021.

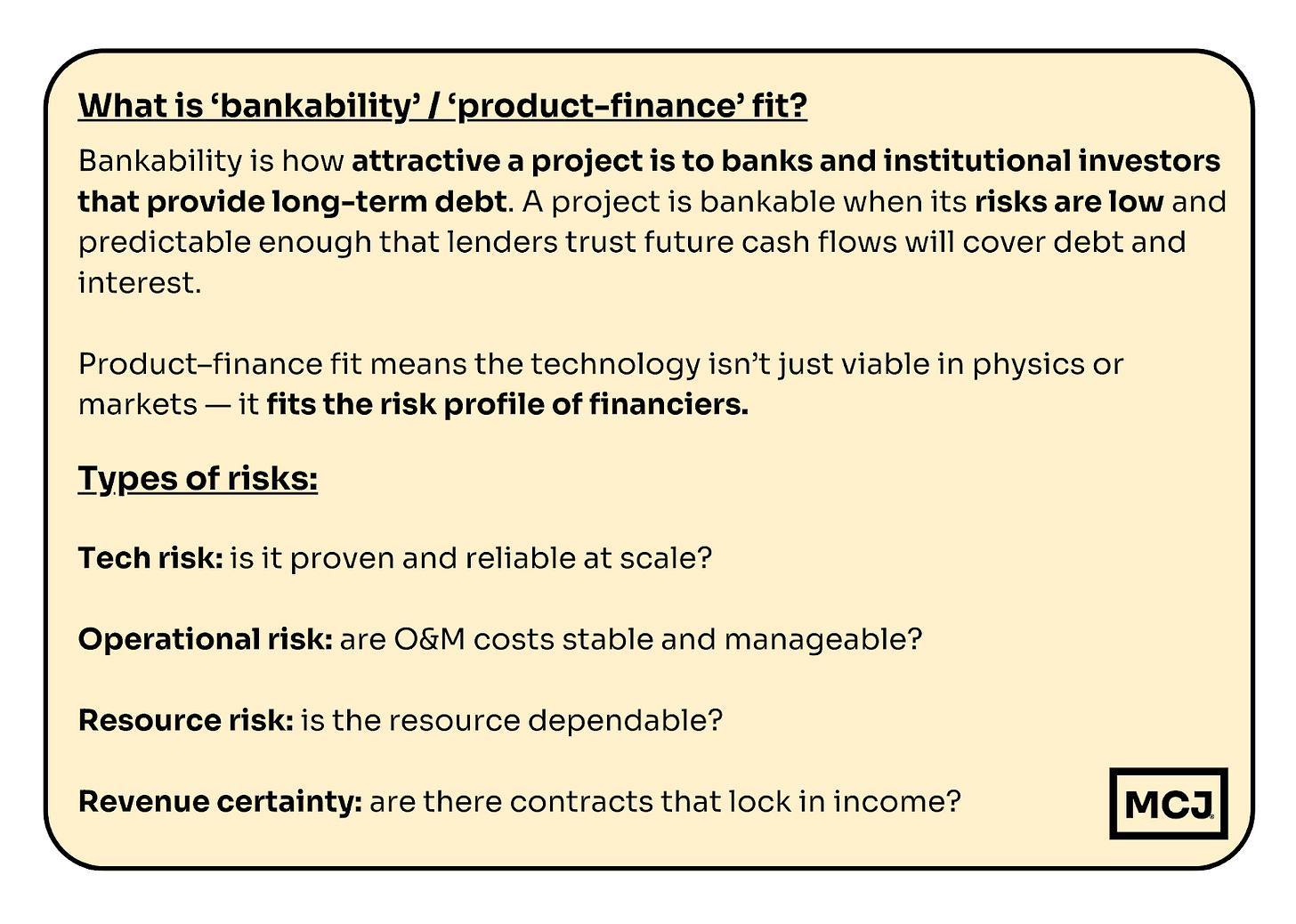

Despite these tailwinds, one bottleneck remains: deep tech energy startups must access FOAK project financing- that is, non-dilutive capital for new technologies to grow from pilot to commercial scale.

Rodatherm aims to pave a path for the new era of geothermal to achieve “product-finance fit” by focusing on low-risk sedimentary geology, lowering operations and maintenance (O&M) through a closed-loop process design, and maximizing heat output with an optimized working fluid.

MCJ is excited to announce our investment in Rodatherm’s $38M Series A led by Evok Innovations, with participation from TDK Ventures, Toyota Ventures, TechEnergy Ventures, Active Impact Investments, among others.

What is Rodatherm?

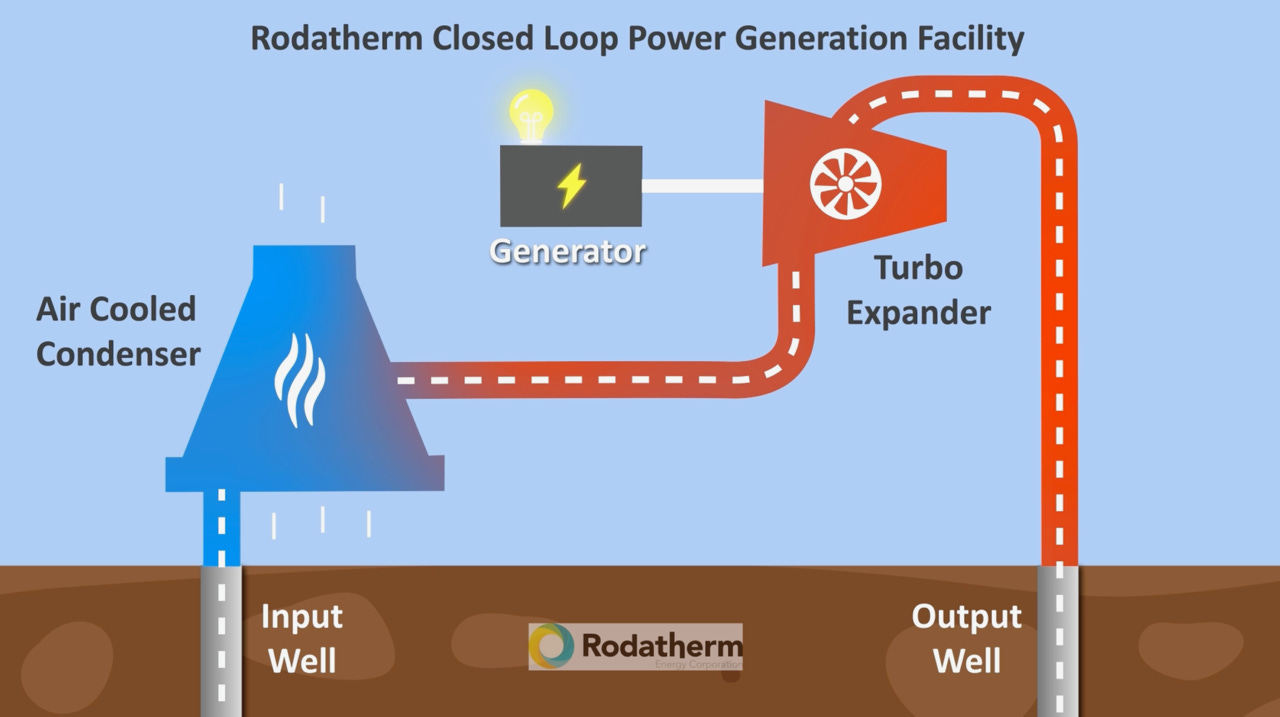

Rodatherm is building a ‘heat pump’ at depth, a closed-loop advanced geothermal system designed to deliver clean, firm baseload power at or below the cost of fossil fuels.

Founded by serial entrepreneur Curtis Cook, Rodatherm is built for bankability. The company drastically reduces both technical and geological risk by leveraging proven oil and gas industry components, targeting sedimentary basins, and using organic working fluids.

The Rodatherm loop design is targeting an LCOE of $50/MWh. This is achieved in part by maximizing both conductive and convective heat transfer from hot wet rock, and by using a heat extraction process that is 50% more efficient than traditional water-based binary systems. The closed-loop nature of the system negates any fluid loss and limits corrosion, further reducing O&M costs while increasing the system’s reliability and longevity to well over 40 years. As the system is completely closed, there are no emissions to the atmosphere.

Rodatherm’s CEO, Curtis Cook, has a track record of building and scaling large-scale energy businesses. Most recently, he founded Vesta Energy, transforming a single well discovery into a shale company with a $1B asset value. The design of Rodatherm’s 5-loop closed system was built from Curtis’ decades of experience in horizontal drilling at Vesta and his other ventures.

Operating in stealth since 2022, Rodatherm has a pilot project underway in Utah, with plans for testing its 1.8 MW demonstration project by the end of 2026. Rodatherm has also secured an offtake agreement with UAMPS, the local power utility.

Why Did We Invest?

Product-Financing Fit

In today’s energy landscape, product–market fit is clear - the world has an insatiable appetite for clean, firm baseload power. The harder challenge is product–finance fit: securing the non-dilutive, project-level capital required to build high-CAPEX, first-of-a-kind plants. This financing bottleneck (often called “Valley of Death”) is the critical stopgap for scaling deep-tech energy solutions.

Curtis and the Rodatherm team are tackling this head-on. With decades of experience financing and scaling multi-billion-dollar energy projects, Curtis knows that a technology must be engineered not just for physics, but for project finance underwriting. Every element of Rodatherm’s design reflects this: off-the-shelf oil and gas components, a well-understood process cycle, a closed-loop system with no fluid loss or corrosion, sedimentary basins with low subsurface risk, and efficient PAD design to maximize capital efficiency.

This focus on bankability—reducing risk, stabilizing costs, and boosting efficiency— positions Rodatherm to effectively navigate its non-dilutive financing needs after the completion and successful demonstration of its pilot project in Utah. We are thrilled to support Rodatherm in its mission to bring firm, carbon-free baseload power to the U.S. grid and to markets around the world.

Congrats for recognizing the key role geothermal can play. I've been tracking Fervo's progress for a number of years. In July, the company's 500 MW pilot plant in Utah achieved numerous firsts while hitting all its metrics. Not sure how Rodatherm's technology compares, but there's plenty of room in the market for multiple approaches.

There's no question there should be more focus on geothermal. The DOE believes that geothermal can produce 90 GW of power by 2050 or about 9% of U.S. electricity needs. The good news is that advance and enhanced geothermal is being proven viable in the real world and is far more promising than either solar or wind in terms of providing baseload power.

how is the closed loop managed?