Polarization has finally reached Wall Street: The climate threat and opportunity

We cannot solve climate change without investment. According to the Climate Policy Institute, to be on track to avoiding catastrophic warming, $4.35 trillion dollars need to be invested annually into climate solutions by 2030. That’s 7x more than we invested in 2020.

Up until recently, the pressure on Wall Street has all come from the left. For every action, there is an equal and opposite reaction. Anti-ESG, anti-woke investing is here. In our polarized society, the political right has an answer to the divestment movement.

Does this put our climate investment goals in peril? Maybe. But it could also be just the opportunity we need.

The Beginnings of Anti-ESG

In February of 2022, the Texas Teacher’s Pension fund sent an open letter to their asset manager, Blackrock, demanding they cease all discussion of divestment. While Blackrock bent over backwards to assure them of its long term commitment to fossil fuels, it was no use. Republican state legislatures across the country saw an opportunity. Texas may have gone the farthest, banning any state funds to be managed by banks or investment firms that have ESG offerings.

Then, in August the DRLL ETF came out. Launched by the author of Woke, inc, it is almost identical to a generic US energy index fund, but has an explicit mandate to pressure those companies to: drill baby, drill. Even though it costs >4x more than the equivalent index fund (.41% compared to .10% for XLE), it has taken off, growing from $27m in holdings on its launch to over $320m (as of September 21st).

It has been one of fastest growing new ETFs ever.

What’s at Stake

On first take, the success of the right’s backlash here is not good news. It relieves pressure upon major Wall Street organizations to take science-aligned climate actions by giving them the excuse of another constituency to appease. And, like Trump railing against electric cars in a recent rally, it deepens the narrative that climate actions are something only for liberals.

If half of investors are calling for the divestment from fossil fuels and reinvestment into climate solutions, and the other half are buying oil companies to mandate them to drill, we’ll be unlikely to bring down global emissions in time.

The Truth Anti-ESG Investing Is About to Face

While polarization has now entered finance, the industry itself is far from polarized. “Greed is good” still rules.

We spent years convincing them sustainable investing is the moral thing to do. Now it's time to convince them it's also the financially smart thing to do.

Thankfully, it’s not hard to make the case that climate-smart investing is smarter investing.

Fossil fuels are being outcompeted by EV’s, renewables, and batteries in both of their core markets (transportation and electricity).

The pathway for economic superiority for the next generation of climate solutions (heat pumps, building retrofits) is set at this point.

The investment potential is sky high for the generation of climate solutions after that (green hydrogen, mass carbon sequestration, zero carbon cement & steel, etc.).

So what would you prefer in your retirement fund?

Blockbuster or Netflix?

Nokia or Apple?

Fossil fuels or climate solutions?

This is how we need to frame the question. This is a technological transformation and the louder we shout it, the faster it will go.

The Climate Community’s New Foil May Help Us Redefine Fiduciary Responsibility

There is a world where DRLL and the right’s legislative push back can help us reach our climate finance targets. We have the opportunity for a narrative reset. And it is who wins the narrative that will win the day.

For decades the narratives that “fossil fuels are a necessary investment for competitive performance” and that “green investing underperforms, so should only be undertaken as an act of charity” have been pervasive, making fiduciary investors nervous about adopting them in endowments and 401(k) portfolios.

But the Anti-ESG crowd has thrown out fiduciary logic by arguing that values can be incorporated into financial and investment decisions. Texas’ anti-ESG law has reduced the number of investment firms it can work with. This lower competition is modeled to cost the state over $500 million in higher fees.

This opens the door for a new sweep of legal challenges to the fiduciary duty and creates an opportunity to shed light on the underperformance of 401(k) fossil fuel positions. The S&P 500 Energy index has had a 0.78% return over the last 10 years as of September 14th, 2022 compared to the broader S&P 500 which gained 10.42% annually for the last 10 years as of September 14th, 2022.

Let’s Close the Climate Investment Gap

While for most climate actions, the best time to do them was yesterday, this is an opportunity whose impact can be greatest right now.

Make sure your investments are divested from fossil fuels and reinvested into climate solutions.

Make sure your company’s 401(k) offers climate-focused portfolios.

And absolutely make sure that you take every opportunity you get to reframe the narrative.

It’s why we launched Carbon Collective’s robo advisor, employer 401(k) and our new ETF–climate investing is smart investing.

The faster that climate and regular people realize it, the faster we can unlock the capital we need to solve the greatest challenge of our time.

✍️ The Draw-down

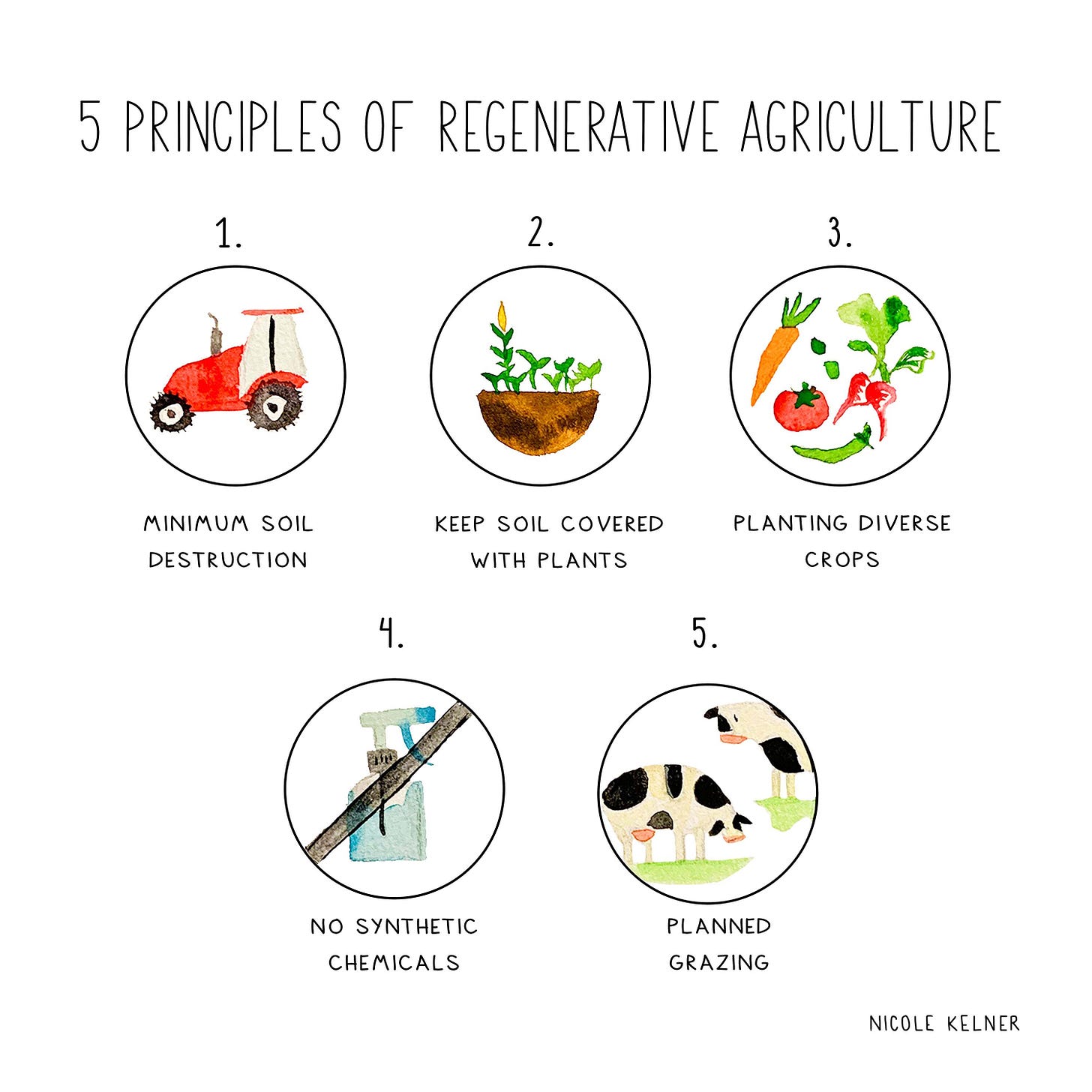

Weekly climate art by our MCJ Artist-in-Residence, Nicole Kelner. Don’t miss the next Climate Art workshop TONIGHT 9/27 at 6pm ET. The theme is regenerative agriculture and participants will learn how to create this piece. RSVP here.

📢 Climate Action of the Week

Want to do more? Sign up for the next Climate Changemakers Hour of Action here.

We're still working to protect our pro-climate-action majority in the House of Representatives! This week, we're supporting climate candidates in key New York districts. Write letters to voters in NY-3, NY-19, or NY-22—you'll need a printer and a Vote Forward account to get started.

🔎 Fresh Takes

From our marketing friends at The Regenerates.

"I don’t feel 'climate-enough' to work in this field." ... "What should I be thinking about to have the most impact as a marketer?" ... "Where are the other marketers trying to figure this out?"

If you are a marketer, storyteller, or culture-shaper that has pondered any of these common questions, join the Regeneration for Marketers program. We'll explore how to put our bag of tricks to use for a cleaner, healthier, and brighter future starting October 5th. Applications close September 28th. Apply now.

🎙My Climate Journey Podcast

🏛 Jason talked with Camila Thorndike, who previously managed Senator Bernie Sanders’ portfolio on climate. They cover the IRA, climate justice, energy poverty, the policy and regulatory landscape, and tons more. The conversation is a great follow-up to a previous episode with Benji Backer, who is very active in the conservative climate circle.

🚛 Cody caught up with Gagan Dhillon, CEO & Co-Founder of Synop, about the electrification of fleet-based transport, his company’s product offering, their consumer segments, and how business will evolve as the EV space matures.

✨ Highlights

💭 CrowdSolve just announced their WeFunder campaign. CrowdSolve is an integrated ecosystem for climate entrepreneurs to confidently pre-incubate their ideas. CrowdSolve sources innovators through partnerships, helping the 99% who don't get in an accelerator. Learn more HERE.

👩💻 Climate Jobs

For more open positions, check out the #j-climatejobs channel in MCJ Slack as well as past newsletters.

Brimstone Energy is hiring chemical engineers and more to work on carbon-free cement. (Oakland, CA)

Burnt Island Ventures is hiring an Investment Analyst to help fund water entrepreneurs. (New York/Remote)

Enode is seeking a Head of Marketing, Senior Bus Dev Manager, Product Manager, and more to join their growing team and accelerate the energy transition. (Remote)

Glint Solar is looking for a Software Engineer, Marketing Manager, VP of Sales and more to help accelerate the solar revolution. (Oslo/London/Remote)

School Of Policy & Governance in is hiring a Head of Net Zero Fellowship and Part-Time Analyst to facilitate executive education programs. (Greater Bengaluru Area)

Tezza Foods is hiring its first Business Operations and Strategy position to help create a more sustainable food system. (Oakland, CA)

The Fitting Room is looking for a Backend Developer who is proficient in Go to help create an inclusive and sustainable fashion ecosystem. (Remote)

XFuel, a third generation bio-fuel company is looking for a Founder's Associate to join their mission of decarbonizing transportation. (Mallorca, Spain)

🗓 September Events

For more climate events, check out the #c-events channel in MCJ Slack.

🎨 Climate Art Workshop w/ Nicole Kelner: TONIGHT! Theme is regenerative agriculture. (9/27)

💁♀️ MCJ’s Women in Climate Meetup: Monthly meetup for women who work in, or want to work in, climate. (9/28)

🇬🇧 MCJ London October Social: Monthly 'MCJ First Mondays' socials in London where you can converse and connect with entrepreneurs, operators, investors, academics, explorers, students and more who are all passionate about climate solutions too. (10/03)

🎓 MCJ Early Career Meetup: Participants will have conversations in small break-out rooms and hear from some others who have experience navigating working in climate post graduation. (10/03)

🍻 MCJ Climate Tech Boston Meetup: Monthly gathering for the Boston MCJ and larger climate tech community.

MCJ Climate Voices is a free weekly email curating news, jobs, My Climate Journey podcast episodes, and other noteworthy happenings in the MCJ member community.

💭 If you have feedback or items you’d like to include, feel free to reach out.

🤝 If you’d like to become an MCJ community member, apply today.