Episode 186: Tackling The Climate Crisis with Speed & Scale Co-Author, Ryan Panchadsaram

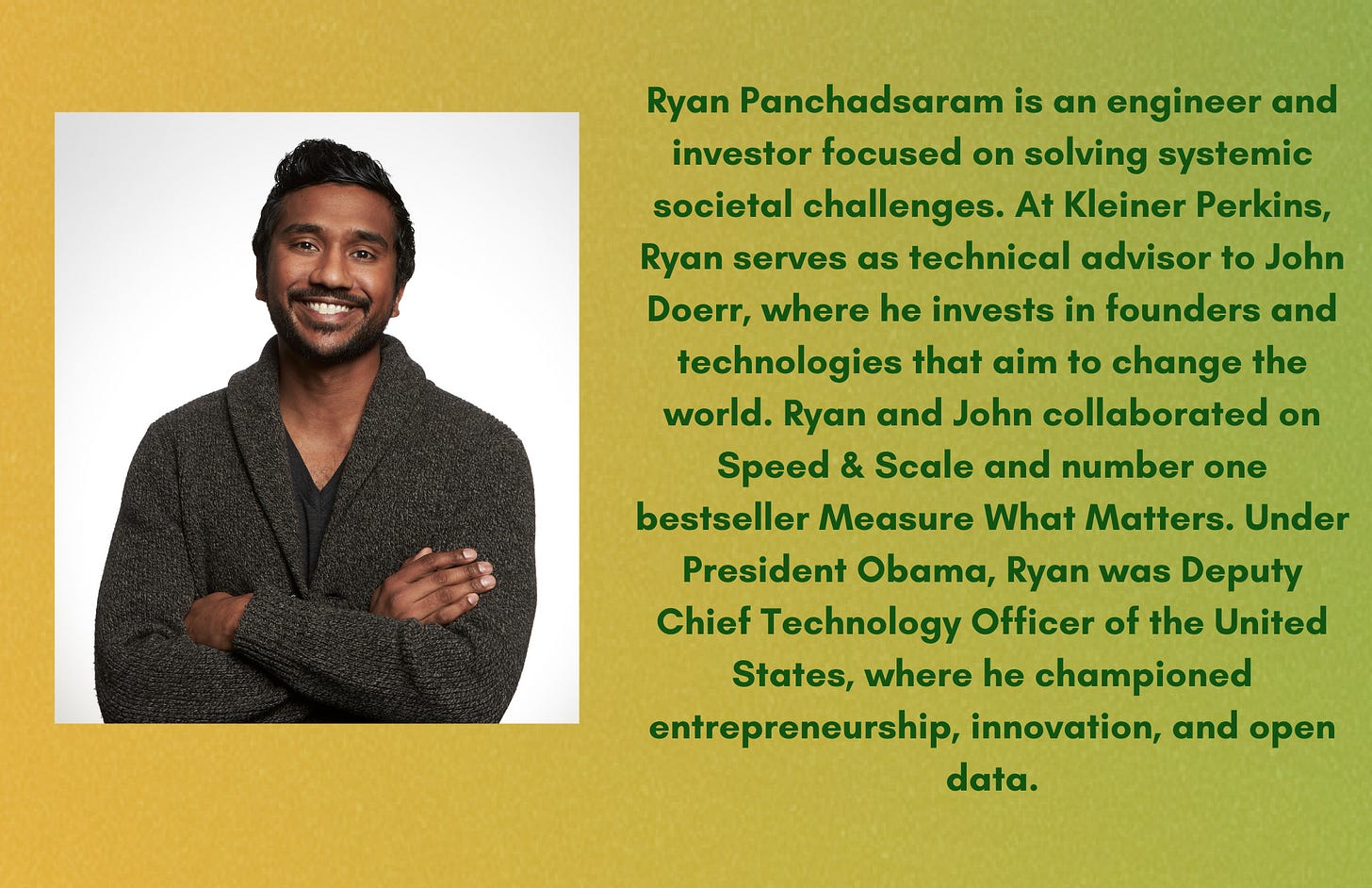

Today's guest is Ryan Panchadsaram, Technical Advisor to John Doerr, Chair of Kleiner Perkins, & Co-Author of Speed & Scale. We dive into Speed & Scale, Ryan’s new book that offers an unprecedented global plan to cut greenhouse gas emissions before it's too late. We also explore the misconception that climate investors have to sacrifice returns for impact, the importance of policy and innovation, and why social justice and the climate crisis are interwoven.

As always, please consider giving us a rating or leaving a review. We heard that helps spread the word about our little show and engages more folks in the climate fight!

How do you think about the problem of climate change and what levers of change are you focused on?

I spend a good, perhaps significant amount of my time on you'd call it, broadly solutions to the climate crisis. And we try to pull on multiple levers. We try to prolong the for-profit lever, actually investing in companies. We pull on the nonprofit lever. How do you support nonprofit groups that are out there that are trying to advance decarbonization efforts? And then we believe in advocacy as well too. Do you have to change the policy and politics of things?

You were sharing that the first episode you did was in 2019. I think 2019 for us was an important year as well because we started to try to wrap ourselves, our heads around this problem, right? John's been working on trying to tackle the climate crisis for 15 years. For me, it's just been the past five and really it's been trying to keep up with him. And so in 2019, we had this moment to say, "Well, how can we take a step back?"

And if we were to take a step back on this crisis, what would it look like? And the question that we posed to each other at Christmas 2019, right? Pre COVID was, what would it look like if you applied OKRs to the climate crisis? What would it look like if you set objectives and key results? Like, that goal-setting tool used by Google and others. And John wrote a book called Measure What Matters that I helped with that really unpacks his practice. Like, if you're going after an audacious large goal, using OKRs is a pretty neat way to do it.

And so what we did is we set out to try to answer that question. And so Christmas rolled around the start of 2020 happened and we just started having conversations where engineers and investors and whenever you're looking for a solution, you actually first go to talk to people and you actually go to learn. And so we started having these conversations in person, and then because of the pandemic, they switch virtual very quickly. And because of Zoom, we could click record on all these meetings.

By the time we got to conversation number 30, we realized that all the amazing gems that people were sharing in these interviews are what could inspire people. These OKRs are the numbers and maybe the framework of how to think about it, but the magic we're in these interviews. And so this project just to craft OKRs turned into one to say, "Well, what if we put together a book?" And so that's when Speed & Scale was born ad the idea for it, two years ago.

What is your hope for readers in terms of if there's one takeaway that they had coming out of reading the book or one thing inspired them to do, what would that be?

One takeaway is that to tackle this crisis it'll take collective action. Not only the individual action. So individual actions are expected at this point. If you can afford it, you gotta switch to an electric vehicle. You gotta try to make your house more decarbonized, i.e. getting solar or getting rid of gas, but all of the individual actions that you and I can take, Jason, will only add up to so much. You and I don't control what flows into our grid individually. You and I don't control the subsidies that could go to electric vehicles to accelerate that transition.

And so one of the things we try to point out in the book is that if you can get three people together, five people together, 20 people together, you can create a movement around particular areas that go for the gigatons. And so what you and I can do if we lived in San Francisco would be to petition our government to put a proposition, to really pressure the politicians here to make this grid green and not in 2030 and beyond, but really push them to do it by 2025.

And by doing that, you actually remove so many more gigatons than the actions you're doing alone. Another example of this is we think about the transition to electrifying vehicles. You and I can make that switch, but for most folks, they're gonna keep their cars for another five, 10 years with a capital stock turnover these things is going to take a long time. And so that's where policy can come in, where policy can come in and say, "Hey, we're gonna incentivize people to switch now." "We're gonna incentivize people possibly getting rid of their fossil fuel vehicles and making that switch?" Or you know what? We can fund public transit that's electrified like electric buses." Or what if we introduce alternatives in cities that don't even require cars like protected bike lanes, right?"

Getting people out of a vehicle, to begin with, and actually just using their human power to move around the city. And so the long answer to the very specific question is, what can people take away at that if we want truly go for the gigatons, it's gonna take us working together, and it's gonna take us working together to push on the particular points that true emissions come from.

Can you give us a little post-mortem on Cleantech 1.0 and some critical lessons learned for John during that time?

I think the takeaway very broadly from the public was that Cleantech 1.0, was a failure. And that's absolutely not true. The Kleiner funds that invested in green investments deployed about a billion dollars over that period of time. And if returned over three billion today. If you go and poke and kind of nudge some of the other investors in this space, they'll say the same thing as well too.

With that said, there were a lot of companies during the Cleantech 1.0 moment that didn't make it. And you actually really gotta unpack the why those companies that make it. And Kleiner Perkins invested in seven solar companies and six went under. They all were doing incredibly well until you had competition abroad, until the oil crisis, until there were a lot of factors that played, but particularly in solar and in batteries, if you wanna poke on that as well too, you had a country that said, "We're gonna make this an industrial priority."

And in the US we spend far too much time saying, "Hey, well, this one company got a loan. Well, this company does that. Hey, Kleiner is going in this space, but it doesn't look like it's going too well." And you had China say, "Well, no, we're gonna actually invest in this solar thing. And we're gonna fund and use this as a jobs program." And because of that, you fast forward to today and you have a few things to think you can thank them for the record low prices. You can thank them for the record low prices, both of solar and batteries, but just the sheer production of them that now we can take advantage of.

But I always have to think about what could have happened if the US backed and supported the solar industry as China did. It would probably be a different place. If you look at the world's green billionaires, that list just came out. You've got Elon Musk, of course at the top, but the rest, the rest of the top 10 are from China, from solar and battery storage businesses, right? Those could have been hours in that first era, Jason, but we let that go. And so I think almost the charge and take away from that right now in 2021 and going into 2022 is, what cleantech industries does the United States wanna win at?

And the question goes just as true for any other country that picks up speed and scale. What do we wanna be great at? What do we wanna specialize in and what do we wanna export? When you look back though, if we wrote Speed & Scale three years ago, we wouldn't have this success story that we have today, right? Just in the past three years, you've got Enphase, Sunrun, Beyond Meat. You've got Tesla, of course, you've got quantum scape as well too. You've got these incredibly large public companies in the multi-billion dollar, as well as in Tesla's case, the trillion-dollar range that has come from cleantech.

And so only now, only recently can we now point to the actual financial successes of it, but it took a lot of grit. It took a lot of persistence, the Kleiner team, the founders themselves behind each of these companies, Jason, that was a hard, hard, hard time when the world was saying, "Hey, cleantech is not working. Why is this space happening?" And you have these founders just tearing through finally making it public. And then now you fast forward to today, there's true excitement. There's this cleantech 2.0 revolution that's happening right now because one, we have proof points of it working, but there's just a lot of scar tissue now of what people know they can get their hands into. What's a good space to get in trouble in. And if you're gonna get in trouble in a space, you know who to ask for help.

As I'm listening here is a pretty pragmatic view where you're not saying that entrepreneurship is the only answer, and you're not saying the government is the only answer you're saying that we need both. And I've heard views from people that remain nameless on one side that say, "Give me a dozen entrepreneurs and I'll solve climate change." And, and on the other side, people that say fricking Silicon valley all the airtime and do none of the health, like we already know it and it's all about government and policy and a Manhattan project. And so I guess I wanna double-click on that because you hear that “my companies need to stand on their own two feet and they're gonna be strong and I'm not gonna rely on future policy”, but then you also hear, “but we'll need the policy and inevitably it's gotta come and therefore you can kinda get out ahead of it in certain cases where it makes sense”, where does the truth lie or, or what's the Ryan view or the John view or the Kleiner view or whatever you wanna give me? I wanna talk about this from an investment standpoint.

I'll give you the Speed & Scale view, which is the John, Ryan, but also the near a hundred people that we spend time with to try to craft these OKR. And so the book is made into two parts. The first part is the solutions and there are six objectives there. These are the ones that you and I can recite off the top of our heads to get to net zero. We've gotta electrify transportation, we've gotta decarbonize the grid, fix our food systems, protect nature, i.e., stop deforestation, clean up industry steel and the hard things. And then we've gotta remove what's leftover.

So those are the solutions. If we let nature takes its course, right, or just time take its course, it might take us to 2100 to get there. So how do you make it happen faster? That's the second part of the book. And the second part of the book talks about the four accelerants that we have. We purposefully put them on the same pedestal because each of these accelerants is the things that you and I, and everyone listening, we can shape. You've got the ability to shape politics and policy, right? We've gotta when the policy and politics, we need countries to set bold commitments and follow through. So that's one lever.

The next lever is turning movements into action. That is everything from getting people out to vote, getting people to push their employers, to make these net-zero commitments, it's to change what's happening in the boardrooms, right? Truly movements becoming action. The third lever is innovation. The world that we hail from, and the true measure of success for innovation is, can you drive down the green premium, the cost of these green technologies? That's the true north star there. And then the fourth lever accelerant is an investment. We've got to invest more in R and D. We've got to invest more in venture and deployment and philanthropy.

And so at any time, you feel like one lever is not living up to its potential. You've gotta pull on the other three. And so Jason, we're rolling off the end of cup right now. And you have some words of promise and hope from it. Like, it's the first time that coal is truly being talked about in a way that it's gonna end. You've got some 2030 targets for methane and forests, but on the flip side, you've got goals that this group is setting that are in 2070, '60 some countries putting milestones so far out, that you don't even think any action is truly gonna happen in the next 10 years.

And so if you're feeling like the policy and politics is failing you, in this case at corp, well, we've got to pull on the other three. We've gotta get people out to vote, to change leaders, turning movements into action. We've gotta get companies to say, "Hey, you know what? That Paris thing, 2050 is cute. Let's do it in 2040. Let's actually step up our ambition." You and I, and the crew. That's our investors that listen to this. We've gotta invest in companies that can drive down the premium 'cause there's no way this transition happens if the cleaner and greener thing is more expensive. And so if there's a north star for all of our investment activity, it's to drive down that premium.

And for listeners, the green premium is the added cost of the cleaner and greener thing. It's a term that Bill Gates really coined and writes so beautifully about in his book. And the thing is when the green premium drives down to zero and flips, you get a green discount. And when a green discount happens, you can't stop the market's Jason, like they're just gonna flow. And then, of course, invest, invest, invest. If you look out there and see oil being used, you look out there and see cars physically being driven around, the only way for people to turn those over is if money is flowing. So those are the four things we can pull on. In the book, we've got these 10 objectives that are paired with key results as well too. And so there are measurable things in the Speed & Scale action plan that show up for success at these are not.

Now, this is more of a logistics question, but in terms of climate investment, what is the overlap between the climate investing that you and John do and the Kleiner funds and Kleiner LPs versus personal or other sources?

Ryan Panchadsaram: Yeah, the investing that John does, and we do Kleiner invests in clean green tech companies still you've got watershed that we're proud investors of. John is an LP and a handful of cleantech funds from the breakthrough energy ventures, G2VP, earth shot. And then also there's just a healthy amount of investment coming directly from the family office into companies directly. And so for us right now, it's really about instigating. It's about supporting teams that are approaching this crisis with an engineer's hat on their head, as well as a business plan in hand, as well as all the scar tissue from the past. And so we are active investors, Jason, through every lever, a financial lever that we have, and we're proud of each of the teams that are going after it 'cause each team is different and they bring a different set of skills to the table in investing in these different kinds of cleantech companies.

When a climate opportunity lands on your desk, how do you assess whether it's a better fit for Kleiner or for personal investing? And what I'm really getting at is there's a lot of words that get thrown around about double bottom line or concessionary or additionality or timeframes or risk or capital intensity or whatever. And so is the most impactful stuff, inevitably gonna be the best financial investment over enough time period, or is there some stuff that can be really impactful that just doesn't belong in an ambitious venture style portfolio?

It's a great question. Every company that John and I spend time with, we always go to Kleiner first, that's the hat we wear. It's also our team, it's our home base, but there are some companies that don't fall into scope. You've got a lot of hard tech, cleantech companies that are a better fit for the breakthrough energy ventures crew, or you've got companies that are in that vein that are a bit farther along that fit better for the G2 VP investors. And then there are some that just captivate us so much that we feel like we wanna support from the family office.

I would say that that's kind of on the surface a pattern, but really I think what we're gonna see now, though, this is maybe a prediction for the future a little bit is I think you're gonna see more investors wanting to jump into the cleantech space and to make bets in companies that match their expertise. Like, if you are a firm that's really good at software and that world, you will see a cleantech climate tech venture that's more software-oriented and you'll run behind it.

I think you're gonna see more hard tech venture funds go, "Hey, this new type of battery or this new type of energy generation isn't so far off from my other portfolio. Maybe I wanna jump in here," or, "Hey, these carbon removal technologies don't look too different from the stuff that we fund today." And so I think what you're gonna see in the next two years, really in, in the next year coming up is this expansion that now just like you have many venture funds have an enterprise portfolio, a consumer portfolio and a healthcare one, I, I think you're gonna see a cleantech one, a climate tech one be there as well too because John always says that this is, this opportunity around cleantech is underhyped.

He was famously back in the 90s, said that the internet was underhyped. And he's like, "Ryan, that's true today too, for the climate tech revolution." Because when you look out there and the sheer amount of turnover that has to happen, the market sizes are so big. We barely, what 4% of cars are electric? That means 96% of cars not only need to be new cars but new batteries. When you look at our grids, they're still incredibly behind on zero-emission technologies. That's an opportunity as well too. And so the tam is sitting in front of us. This economic opportunity is sitting in front of folks and I think smart investors, smart venture capitalists are gonna say, "Well, hey, how do I take my skills and take and get a portion of that?" And so you're gonna see more capital flowing here.

So if you are framing yourselves as a climate fund, let's say, how do you staff up and be in a position where you feed rounds and not be a reckless fiduciary?

The neat thing here is what you're seeing is you're seeing funds assemble really diverse characters, right? Not just financial investors, you're seeing them assemble scientists and engineers and former plant managers and folks that have had, you know, you know, rolled, rolled up their sleeves before and, and try to tackle this. And so I think for a fund to be successful in this space, you've gotta have the experience on the ground. In the world of consumer tech and enterprise tech, a lot of investors have that experience because they've worked in those companies, there are from Silicon Valley and they have, but in the climate tech space, you're gonna want to assemble a team that is either been a founder or been a, you know, a key employee in one of these kinds of companies.

And you're also gonna want to have a team that knows how to fund a business, raise capital for it because I think one thing here is for any of us investing in cleantech, this isn't a passive exercise. We're all gonna have to roll up our sleeves and help our companies as well, too. So, that's something to keep in mind.

Now, one debate I've heard is when it comes to breakthrough technology when people from the broader climate world that aren't the sort of people that hear innovation. You and I, I think means something different than what they hear, because when we say innovation and dumb, if you think definitely, but I assume you're talking about just small high-growth companies, some breakthroughs, some less hard science, a wide range, but just a for-profit small high growth growing something from small to hopefully really big some data pick off one meaningful problem with unique differentiated solution. But what they hear is they hear breakthrough like new, novel, in the lab, right? And they're like, "We don't have time. And it's a distraction because we just need to deploy what we've got." What would you say back when you get that objection?

You'll hear this saying that we have all the technology we need. We don't need to invent anything new. Why are we obsessing with technology? And the truth is we have maybe 70% of what we need to get to net-zero with solar and wind prices at record lows, lithium-ion batteries at record lows, both are just causing deployment at a scale we haven't seen before, but the reality is still, you can't flip on the sun or wind at a flip of a switch. And so you can't yet replace the gas peaker with that. And so you need to develop storage technologies. You need to develop possibly advanced, safer nuclear to fill in those gaps.

And so what we like to say, what I like to say is we need both the now and the new, and we need to scale up the now, which is gonna still be incredibly hard, but we also need to invent the new because there are harder things we haven't solved yet. Like, how do we completely decarbonize concrete and cement? How do we completely decarbonize steel? We still need pathways to that. When I think of innovation in this space, and I'm gonna point to the key results that are crafted for chapter nine, which is the innovation chapter in the book.

There's a KR around batteries. Innovative companies around batteries can help us reach the 10,000-gigawatt hours of scale that we're going to need every year. And to do it less than 80 bucks, a kilowatt-hour, both of those targets were way off. We're a bit closer on the kilowatt-hour, dollar, dollar one, but definitely not at the pace of building. You're gonna have to KR-92 is on electricity. If you're an innovative company, you may look out there and say, "Hey, I have a pretty neat way of generating electricity. It's a safer form of nuclear or a different form of geothermal."

We've got a KR on green hydrogen. If all the promises to green hydrogen are to come to fruition, the cost of that has to go down, down, down. We have a KR around carbon removal. We're going to need anywhere on the order of five to 10 billion, tons of carbon removal by 2050. This year alone, I think only 4,000 tons have gone into the earth. And so to go from 4,000 to 5 billion, that's gonna require innovation and some incredible companies. And then, of course, carbon-neutral fuels, Jason. We still see a world that isn't going to stop flying.

And so if we truly want to get to net zero, we've got to make the acceleration to sustainable air-fuel and then really invent and then scale up carbon-neutral fuels. So, in the realm of innovation, those are sort of the five areas that just stand out to both John and me, and they are our KRS and the Speed & Scale plan. And for any of them to be successful, there are dollar targets for each.

You mentioned before the green premium for performance, let's say, but given what, some of the models and what a lot of experts seem to say about how bad things are gonna get, how do you navigate, for example, energy poverty, and the billion plus people that don't have access to basic electricity and, and the people like the de-growth or the people that say like, "We need to slow down and get back to yesteryear when we didn't have, like, when we read by candlelight or something." How do you navigate? Or how should we navigate and think about those trade-offs?

In the book, we talk about this very carefully because there are a few important points to make. The first is as the historic alpha emitter, the United States, Jason, we've got to run first. We've got to be the first to decarbonize. We've got to be able to be the ones that show the world that it's possible. Not only 'cause it's the right thing to do. It's also a selfish reason to do it too. If we do that, we'd likely be the creators of the companies that are championing this revolution. Countries like Europe and China need to be there right behind us, 'cause they are also the alpha emitters. You have a category of countries that aren't as energy-rich as the United States. There's a lot of countries that fit in that bucket.

And the message to them is to reach energy security. They should be able to deploy the technologies that they have in front of them. And in most cases, that technology choice might be gas, but we put the humongous reminder out there is that investment in a gas plant. Definitely not coal. Coal has to end. It as economically not financially, not a smart business decision, nor is it good for the planet, but you're gonna see countries deploy gas, but our reminder is solar and wind costs are dropping so fast.

Don't build your grids like the United States did leapfrog us, put solar in the ground, put wind in the ground, do things more decentralized, get the storage that you need. And of course, you likely are going to have, to have one or two gas peakers, but don't put all your chips in the direction of the fossil fuel past. Sacrifice was a word you used. And I think that the movement around that needs to be proud and loud because that is one way to tackle this, but it's not the way that's gonna get us to zero.

When you look at this problem, we actually have to find ways to cut switching to the alternatives. I think when you look at COVID and look at how countries reacted to it, you couldn't find sacrifice in there from one group of the United States. And that was really sad to see because, in this crisis, that's the climate crisis. You hope that we can sacrifice, but you see examples around us where that's not possible. And so like I kinda said earlier, well, when one thing fails, pull on another lever, it's where the costs of the cleaner greener thing have to drop.

And so you and I, and our entire community need to run and deploy and invest and drive down these costs because that's the only way where sacrifice isn't the choice. It's actually the alternative is. So instead of buying that fossil fuel vehicle, you're buying the EV, that's affordable. The energy that comes into your house is from solar, wind, or nuclear, or something cleaner. And so if I'm putting my chips behind anything, it really is around driving down this cost because that 59 billion tons of emissions are someone else's business model and they're not stopping. And so the only way to take those emissions away from them is to create competitive businesses and technologies that are better than the fossil fuel alternative. And so that's kind of what's on my mind.

Interested in coming on our show? Have a guest you’d like to hear from? Don’t hesitate to reach out! Email us at info@myclimatejourney.co.