Are Clean Energy Tax Credits Safe in This Election Cycle?

by Brandon Hurlbut, Co-founder of Boundary Stone Partners

In a recent letter to our LPs—the investors in MCJ's venture funds—we shared our thoughts on the upcoming election. Notably, it feels to us that the clean energy and climate movement seems less mobilized around this election cycle than it was in 2020, prompting us to investigate what’s at stake. To delve deeper into this topic, we recently had Brandon Hurlbut from Boundary Stone on our podcast (listen here) and invited him back to share his insights.

by Brandon Hurlbut, Co-founder of Boundary Stone Partners

We must take action now to engage with policymakers. The potential election impacts on climate change are significant, especially due to the risks of repealing elements of historic climate policies such as the Inflation Reduction Act (IRA), the Bipartisan Infrastructure Law (BIL), and the CHIPS and Science Act. Those laws included transformational incentives for climate tech including clean energy production and storage; heat pumps, EVs, and carbon capture and removal.

Many in the energy sector believe the IRA will remain mostly intact because history shows tax incentives are rarely revoked. For instance, the fossil fuel industry benefits from many tax incentives such as Intangible Drilling Costs, Master Limited Partnerships, and the Domestic Manufacturing Deduction, that have been around for decades even though the industry is mature and highly profitable. The Intangible Drilling Cost tax incentive was created in 1913 to incentivize risk-taking in oil and gas exploration, but advancements in technology and geologic knowledge have arguably made that incentive obsolete.

Despite the historic durability of tax credits, particularly for oil and gas, our industry may be underestimating what it will take to preserve the incentives in the IRA, BIL and CHIPS. Regardless of who wins in November, a major tax debate will ensue in DC next year, and IRA incentives will be a big focus. The US Government will decide whether to extend the Trump tax cuts that expire in 2025. If nothing is done, a significant tax increase will result. Extending those tax credits would cost about $4.6 trillion over the next ten years according to the nonpartisan Congressional Budget Office.

Because there are deficit hawks on both sides of the aisle, both parties will have to make hard decisions on which government incentives, such as tax credits, stay or go to pay for the extension of the Trump tax cuts. Vice President Kamala Harris, the apparent Democratic nominee, cast the deciding vote to pass the IRA. Despite her deep support for bold climate policy and Republicans’ general support for tax credits, especially those benefiting their districts under the IRA, hundreds of billions in the IRA could be at risk as “pay fors” in the tax debate next year.

Moreover, we must consider the words and actions from former President Trump and Republicans about these historic climate policies. A Republican-controlled U.S. House of Representatives passed the Limit, Save, Grow Act to repeal the IRA. Each Republican voted for repeal, despite the potential for economic harm to their district. For instance, Representative Majorie Taylor Greene’s district includes Qcells’ massive solar manufacturing facility, and her vote put the future of that facility and hundreds of jobs at risk. A few weeks ago, the House Appropriations Committee passed a spending bill that eliminates $250 billion in clean energy lending authority from the Department of Energy’s Loan Program Office. Under unified Republican control, that bill could become law.

Former President Trump has positioned himself firmly against President Biden’s climate policies, pledging as early as September 2023 to “rescind every one of Joe Biden’s industry-killing, job-killing, pro-China and anti-American electricity regulations.”

During Trump’s recent speech at the Republican National Convention he claimed, “They’ve spent trillions of dollars on things having to do with the Green New Scam… And all of the trillions of dollars that are sitting there not yet spent, we will redirect that money for important projects like roads, bridges, dams and we will not allow it to be spent on meaningless Green New Scam ideas,” apparently referring to the Inflation Reduction Act.

Trump led chants of “drill, baby, drill” and said, “We have more liquid gold under our feet than any other country by far.” He added, “We are a nation that has the opportunity to make an absolute fortune with its energy. We have it, and China doesn’t.”

Some of his former administrators confirmed these statements, arguing that Trump will “undo everything Biden has done” and act more expeditiously and aggressively to impose his agenda.

In his first term, Trump rolled back more than 125 environmental regulations and measures to facilitate more oil drilling, expedite permits, and enhance the fossil fuel industry’s profitability. Now, he’s showing us he will continue that commitment. Trump recently promised to oil executives a complete reversal of Biden/Harris policies on electric vehicles, wind energy and any environmental regulation that the fossil fuel industry opposes in exchange for supporting his campaign with a $1 billion donation. High on their list would be the rollback of Biden-era policies that restrict oil and gas drilling, particularly in sensitive areas such as the Alaskan Arctic and the Gulf of Mexico. The industry would also seek to dismantle regulations that impose stricter methane leak standards and limit emissions from power plants and vehicles.

The June Supreme Court decision overruling the Chevron doctrine, a principle of judicial deference to reasonable Federal agency interpretation of ambiguous statutes, increases the scrutiny that the Biden Administration’s environmental regulations may face. Examples of climate policies at risk include the EPA’s recent power plant rules regarding the Best System of Emission Reduction (BSER) for new and existing coal-fired power plants, the EPA’s greenhouse gas emission standards for motor vehicles, the IRA’s 45V hydrogen production tax credit final rule, and the Federal Energy Regulatory Commission (FERC) Order No. 1920 on transmission planning and cost allocation.

As a result, the climate tech sector faces a critical juncture as the presidential election approaches. It cannot take Biden/Harris climate policies for granted, as a Trump presidency is likely going to shift the balance in favor of fossil fuel giants. The onus will be on the climate industry to take action before the election to preserve its future.

You should engage now to protect the climate policies that are benefitting your technology. The following are the best ways to engage in addition to voting:

Educate the public on policies that support climate-friendly technologies and sustainability.

Advocate for protecting the IRA by lobbying elected officials for continued federal and state support. Elected officials need to understand the benefits of these IRA investments and what they mean in their districts and for their constituents. You should invite them to visit your factory or project to see your technology firsthand.

Join a coalition like Clean Energy for America, an organization that amplifies the voice of the clean energy workforce in advocating for policies and leaders to advance just, equitable, and rapid decarbonization.

If you are looking for a resource to be plugged in on climate policy developments, bipartisan experts at Boundary Stone Partners have created a Climate24 newsletter that provides informative content on the federal climate policy ecosystem.

We cannot wait until next year to act to protect our clean energy and climate industry.

🍿 The Lean Back

Learn more about Hoxton Farms’ cruelty-free cultivated fat here.

🎙️ My Climate Journey Podcast

🥓 Plant-based meat alternatives often fall short on taste. But Hoxton Farms is revolutionizing the flavor game with cruelty-free animal fats… without the animals. Co-founder Max Jamilly shares a feast of insights on the future of the alt-meat industry and Hoxton Farms’ pivotal role, plus their innovative pork fat cultivation process, scalability and commercialization plans. Listen to the Startup Series here.

🇯🇵 Japan is critical to the global energy puzzle. Despite a smaller emissions footprint than China and the U.S., Japan relies heavily on fossil fuels, especially after reducing nuclear power post-2011 Fukushima. Isshu Kikuma from BloombergNEF discusses the Japanese energy economy and decarbonization efforts. Listen to the episode here.

✨ MCJ Portfolio Highlights

Artyc has been named a Technology Pioneer by the World Economic Forum. This recognition underscores the company’s cutting-edge work in cold chain logistics, ensuring the safe transport of medical and biological samples.

Crusoe announced the construction of a 200 MW data center near Abilene, Texas. Crusoe will collaborate with Lancium, an energy technology firm, to bring this AI data center online soon. This marks the first phase of Crusoe’s expansion with a total power capacity of 1.2 GW at the Lancium Clean Campus.

Heirloom announced two new DAC facilities in Northwest Louisiana. The first 17,000-ton facility will be operational in 2026. A second facility with a 100,000-ton capacity will follow in 2027, with plans to expand to an additional 200,000 tons in subsequent years.

The U.S. DOE Loan Programs Office announced a $213.6 million loan guarantee for Solugen's Bioforge Marshall facility in Minnesota to produce bio-based organic acids. This project will create up to 156 jobs and reduce emissions in hard-to-decarbonize sectors.

Charm Industrial was selected as a semifinalist in the DOE's Carbon Dioxide Removal Purchase Pilot Prize. This recognition, part of President Biden’s Investing in America agenda, brings Charm closer to scaling its carbon removal technology.

LevelTen Energy closed $65 million Series D funding round. This funding will support the continued growth of the LevelTen Platform and finance the company’s expansion into new markets, including granular certificates and clean hydrogen, to accelerate carbon-free energy project deployment.

Clean Crop Technologies, Inc. secured $1.2 million in grant funding from the Massachusetts Manufacturing Innovation Initiative (M2I2) to expand its commercial operations in Holyoke.

👩💻 Climate Jobs

For more open positions, check out the #j-climatejobs channel in MCJ Slack as well as our MCJ Job Board.

Account Manager, Community Solar at Arcadia (Remote)

Automation Engineer at Charm Industrial (Fort Lupton, CO)

Customer Success Engineer, Cloud at Crusoe (Dublin, Ireland)

Climate Engagement Director for the Harris Campaign (Wilmington, DE)

Safety, Health & Environmental Lead at Lilac Solution (Oakland, CA)

Process Design and Mechanical Engineer at Noya (Oakland, CA)

Head of Engineering at Overstory (Remote)

Manager, Sales Operations at Runwise (New York, NY)

Analytical Manager at Sublime Systems (Somerville, MA)

Sr. Financial Analyst at WeaveGrid (San Francisco, CA)

🗓 Events

Click the event title for details & RSVP info. For more climate events, check out the #c-events channel in MCJ Slack.

🎉 MCJ Boston x Climate Tech in the City — Block Party: TONIGHT! Celebrate Boston's climate tech sector's achievements and milestones with live entertainment, food, drinks, and networking.

✈️ Sustainable Travel Policies for 2025: Discover the four essential elements that seasoned industry veterans say every organization needs to implement for successful policy development in 2025. This live webinar will feature Jenny Sabineu, Senior Manager of Travel & Sustainability at Salesforce; Sally Higgs, Travel & Events Sustainability Manager at FESTIVE ROAD; Amélie Losanes, Managing Consultant, Sustainability at Advito; and Philip Charm, Co-founder of Clarasight. (Aug 6)

💸 MCJ + Climate People Climate Career Advancement Meetup: In this workshop, you will learn how to negotiate an offer intelligently and get paid your worth. You will walk away knowing how to research comp plans, what to ask for, how to ask for it, when to ask for it, and who to ask. We will also provide negotiation scripts with a 97% conversion rate. This process and these scripts have helped CareerSprout clients increase their salaries by $53k+ in 2024. (Aug 14)

📚 MCJ Book Club: Five Times Faster by Simon Sharpe: Simon Sharpe is Director of Economics for the Climate Champions Team and a Senior Fellow at the World Resources Institute. We'll discuss the ideas proposed in the book. (Aug 24)

The MCJ Collective Newsletter is a free weekly email curating news, jobs, My Climate Journey podcast episodes, and other noteworthy happenings in the MCJ member community.

💭 If you have feedback or items you’d like to include, feel free to reach out.

🤝 If you’d like to become an MCJ community member, apply today.

💡 Have a climate-related event or content topic that you'd like to see in the MCJ newsletter? Email us at content@mcjcollective.com

The most important clean energy bill was the ADVANCE nuclear act. The vote was 88 to 2:00 in the Senate, so that's as bipartisan as you get. Given that no improvements in cost or safety have been allowed by hostile regulators since 1975, there's a whole lot of technology that we haven't used to make nuclear reactors better. Simply using a manufacturing line would would reduce cost and increase quality my more than 10x. And we haven't upgraded to the Apollo era technology from president JFK 's team at oak ridge. That's the best way by far to make hydrogen.

Today we have people called solid state physicists. They have all kinds of tricks up their sleeves that haven't been used in nuclear power. Starting with the transistor! There are nuclear batteries that take advantage of switches. And ways to use nuclear power to eliminate solar panels. Those lead to designs called nuclear batteries that produce electricity directly.

We have terrific ways to prepare fuel and recycle it that were never available in the 1950s.

So the goal of actually drying down carbon from the atmosphere is not out of reach. We just have to stop industry from saying, "we can't afford it- it's too cheap.'

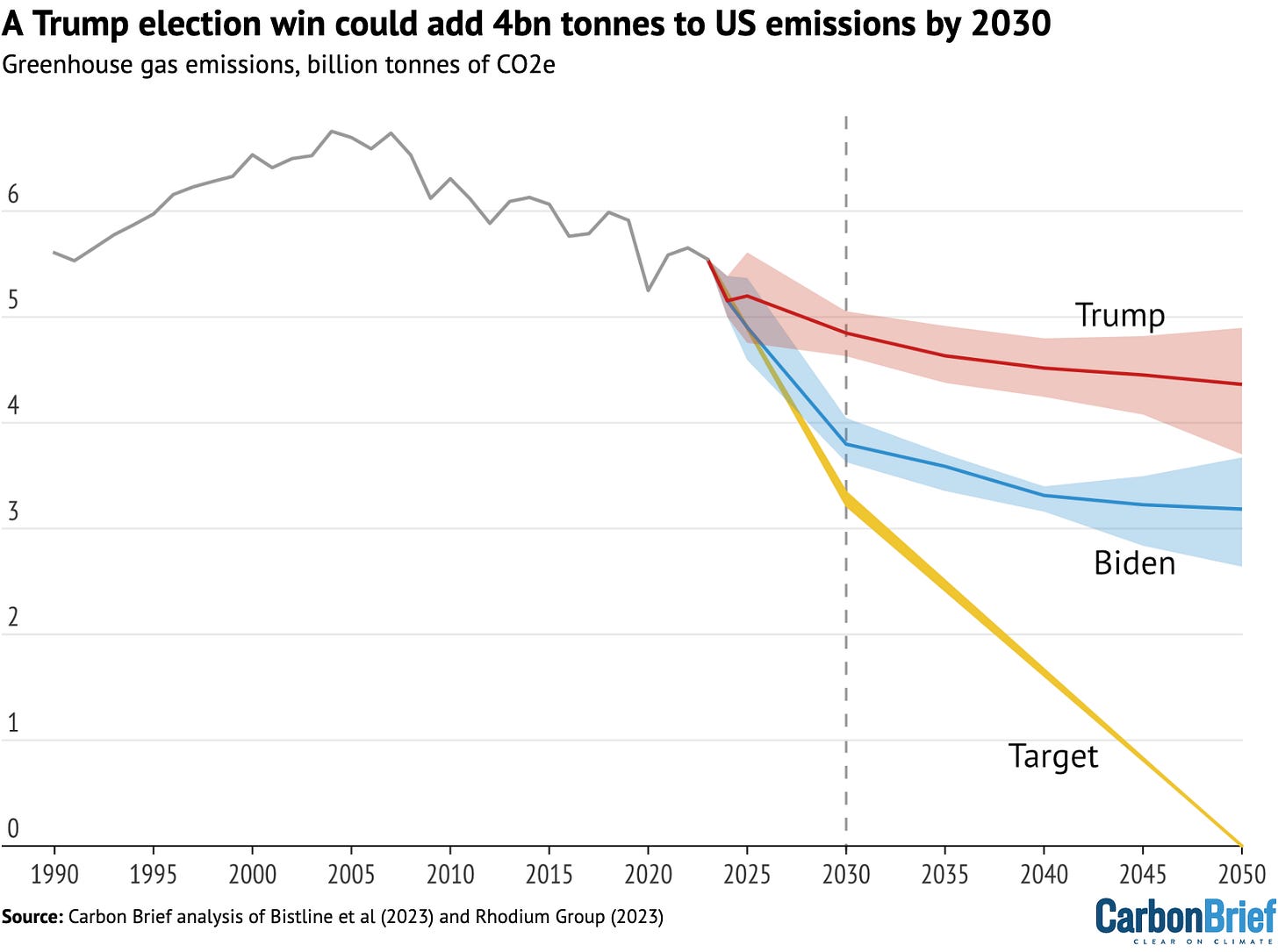

Trump elected again could also affect global decarbonisation efforts too.

Withdrawal from the Paris Agreement will knock sentiment much more than previously as Europe in particular is less cohesivly behind climate policies.

The IRA has an impact on emerging carbon technologies like hydrogen and CDR according to Rhodium.

On a cumulative basis, every tonne of emissions reduced as a result of IRA ECT incentives leads to 2.4-2.9 tonnes of CO2 emission abatement outside the US.